A vaccine to reach full herd immunity

■ Virus waves and lockdowns had a deflationary impact

on growth and required extreme policy measures from

governments and central banks.

■ Recent vaccines have brought optimism. However, distribution and acceptance challenges may slow their deployment and the potential benefits to growth.

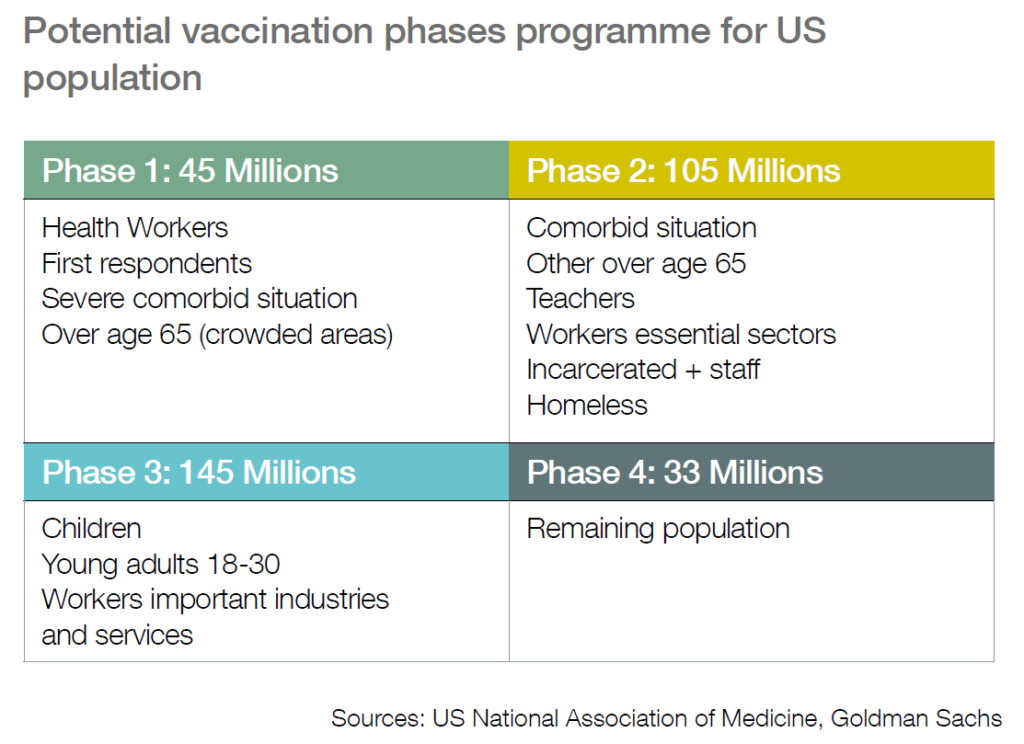

■ Several quarters will be needed to vaccinate populations to achieve full herd immunity. If a vaccine is available in Q1, vaccination will begin with priority groups (health sector, older people) and then extend further to the other groups through the

quarters.

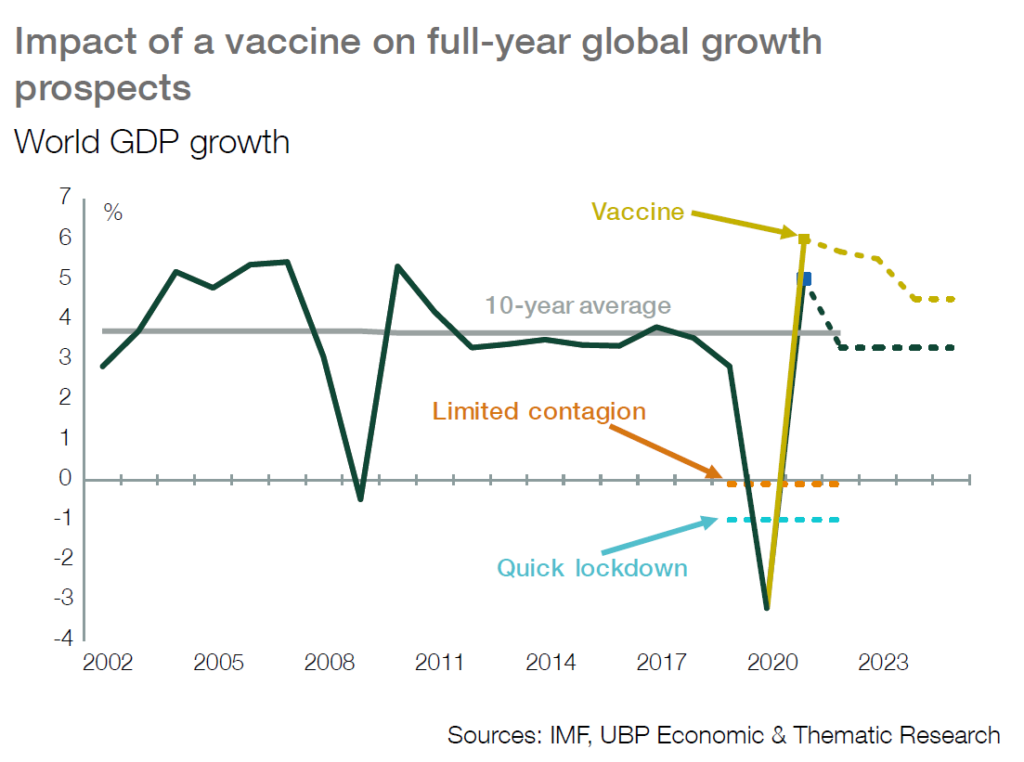

A major boost to the economic cycle

■ With a vaccine, world growth can expect a boost amounting to 1 pp of additional growth, on a full year projection based on our

scenario. If vaccination begins rapidly, positive effects on growth should be seen globally in H2-21 and more fully in 2022.

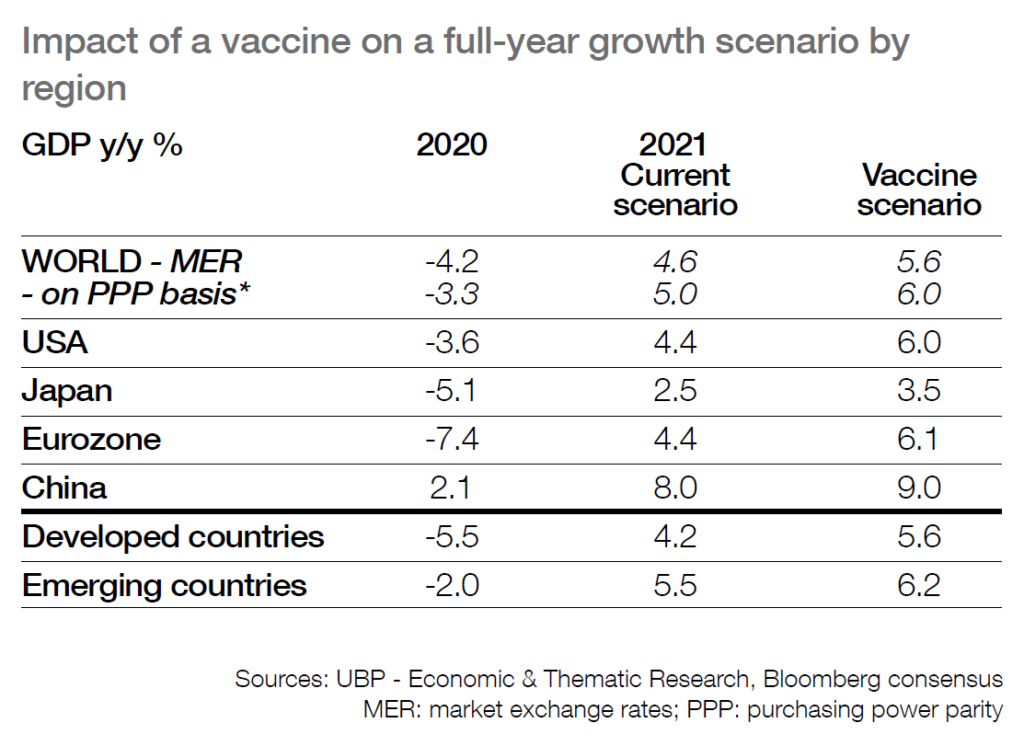

■ Western countries, and Europe in particular, should benefit the most from vaccine deployment in the current scenario. Services and commodity related countries should also draw support from

a brighter outlook. US prospects should also improve, benefiting from local vaccine production and after only a relatively limited recession in 2020.

■ In Asia, a vaccine would benefit India, Indonesia and the Philippines, given the number of cases and the share of consumption in GDP terms. Thailand should receive a boost given its wide exposure to tourism. Finally, China should see limited upside potential (0.5-0.8 pp) as a result of existing virus containment and its mature expansion process relative to other

countries.

Supportive economic policies to stay in place

■ Economic policies should remain accommodative despite the vaccine; budgetary measures adopted should reinforce the recovery and prolong the cycle; public investment into new IT

infrastructure and environmental sectors can boost potential growth and so sustain a longer expansion cycle.

■ Monetary policy will remain accommodative until growth and employment is firmly anchored. Worries about inflation from central banks are unlikely before 2022.