Key points

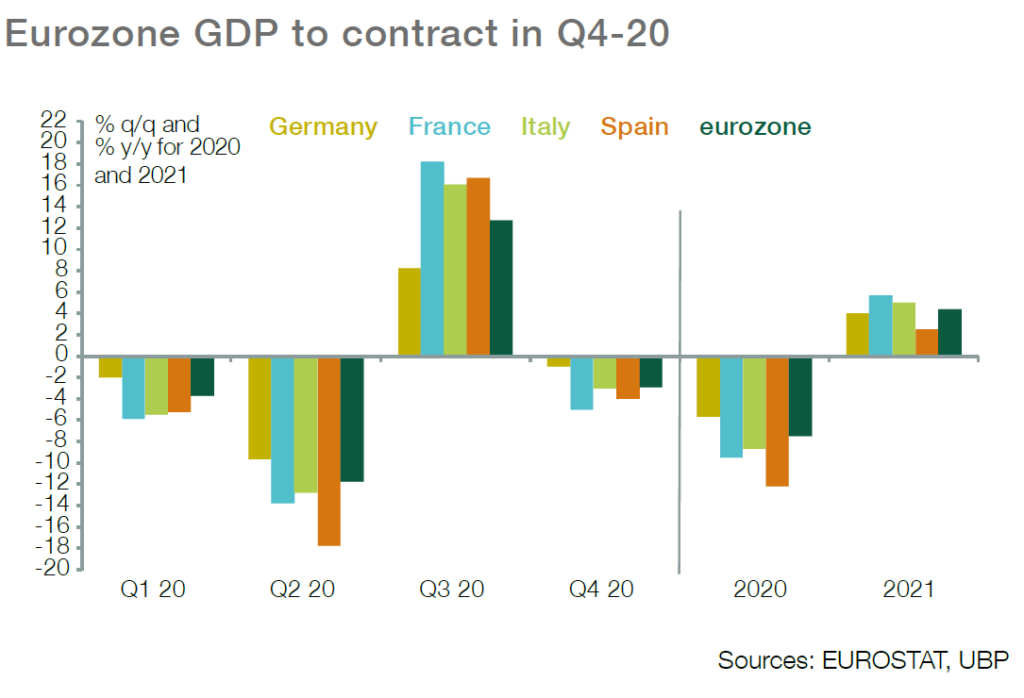

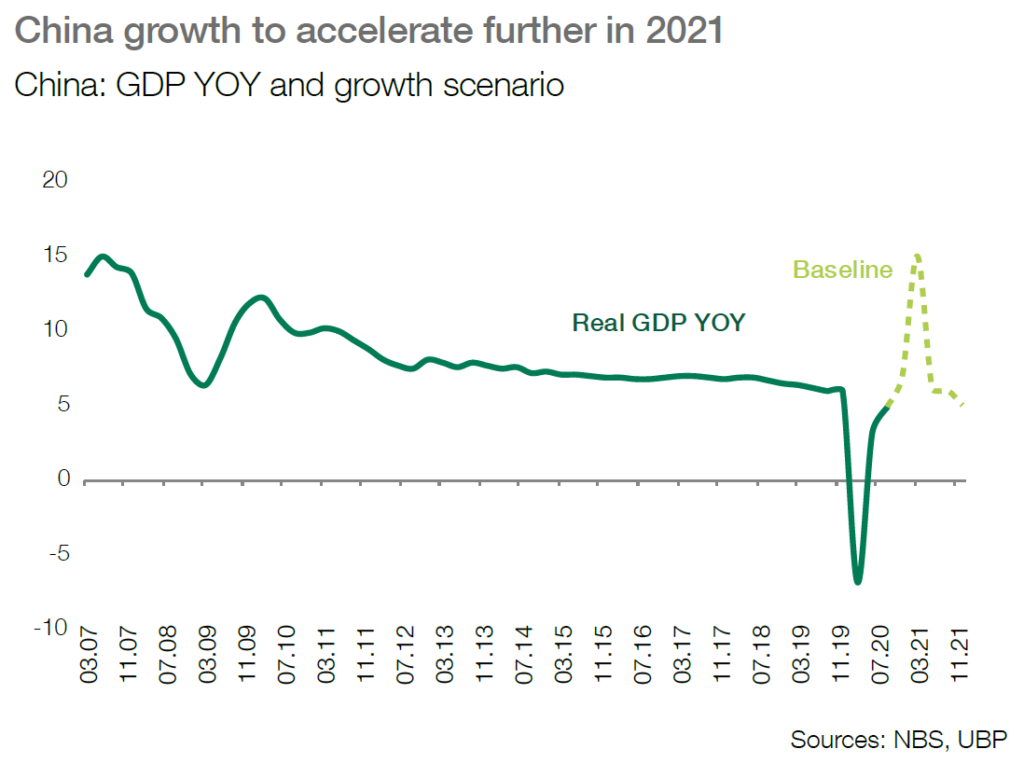

■ Downside risks weigh on Q4 growth in several countries due to rising contagion and pressure on hospitals; European activity should contract in Q4, and a parallel slowdown is expected in the US, while Chinese growth remains on a rising trend.

■ Despite this, a 2021 sustained recovery is still expected, driven by the US, China and Germany. Vaccines should boost the global economic outlook once deployed and contribute to a more sustained medium-term trend.

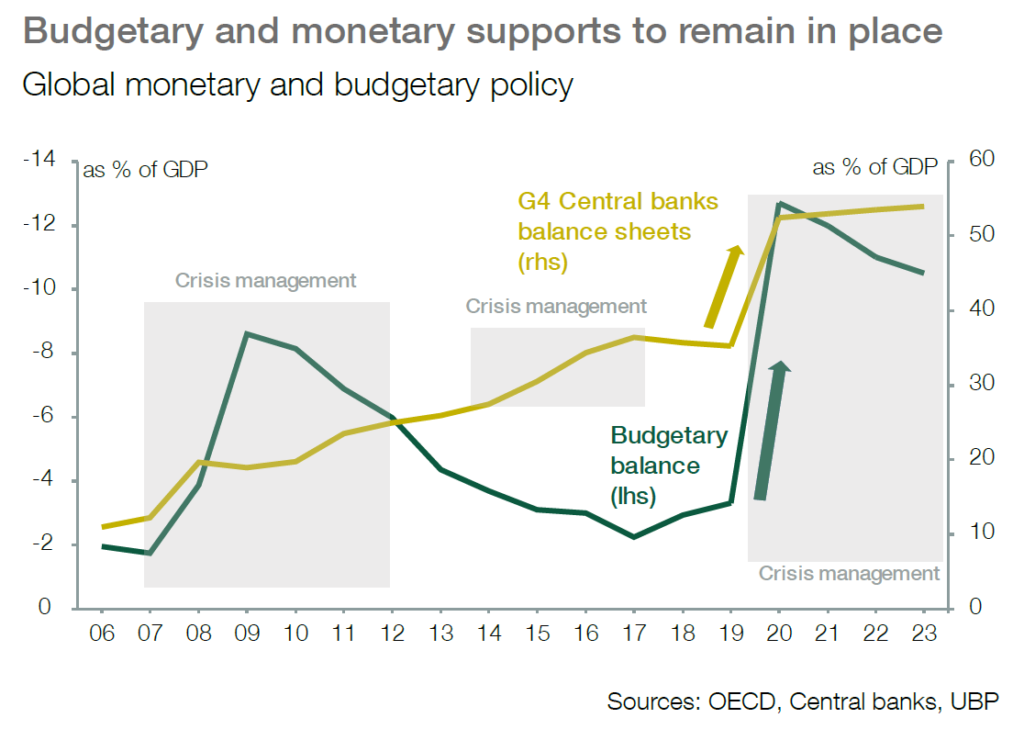

■ Economic policy is expected to remain highly supportive,

even with the arrival of vaccines. More budgetary decisions are expected in the US and accommodative monetary policy seems set to stay in place.

US and China to perform better than Europe in Q4

■ With a second pandemic wave, a sharp contraction in activity is expected in Europe where GDP growth is expected to contract in a -2.5%/-1% q/q range in Q4 in the eurozone, UK and Switzerland. A progressive recovery is expected in Q1 as

restrictions are gradually eased.

■ In the US, activity is losing momentum in Q4, particularly in consumer and services sectors. Nevertheless, Q4 GDP growth should remain positive, in a 1.5%-4% range, and a progressive rebound is expected in H1-21 thanks to more visibility on politics and lower constraints from the pandemic.

■ In China, activity remains on a positive trend; after a rebound in exports and in industrial activity over past quarters, consumption should gain further traction, leading to GDP growth potentially above 6% y/y in Q4-20.

Economic policy: further supports in the pipeline

■ More budgetary support is expected from the new US

administration, initially extending measures in favour of labour, health and local states.

■ The Recovery Fund should be available for euro-members in early 2021, while the latest lockdown has cost each country EUR 10-20 bn.

■ The Fed and the ECB should extend further duration and

purchases of assets at year-end. The delivery of their policy to provide credit to corporates and households is in need of improvement.