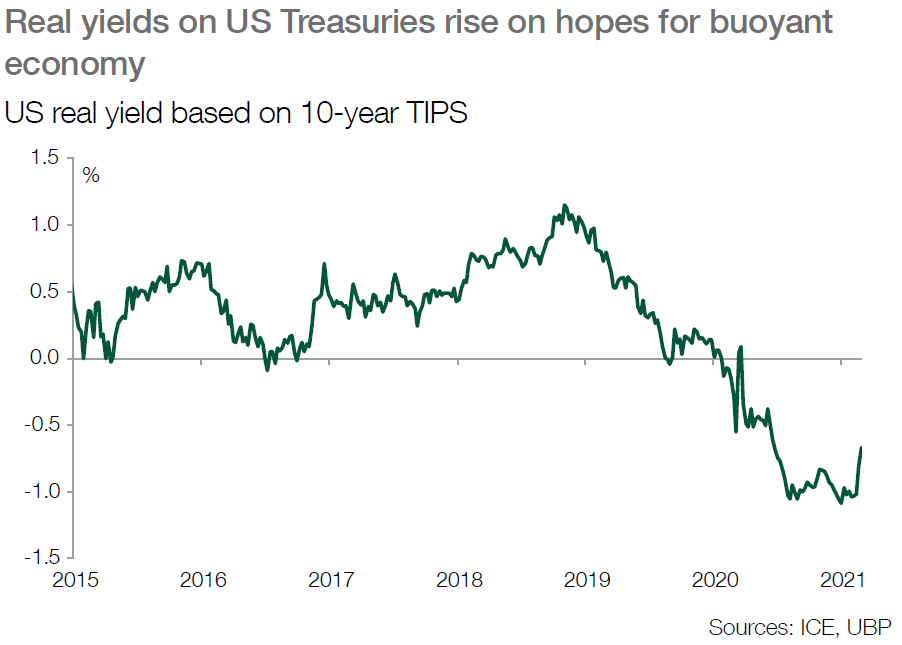

■ The bond markets stole the show this month with sudden increases in yields, greatly worrying investors. The markets seem to be banking on the US economy recovering quickly by the end of the year, whereas the Federal Reserve is staying true to its highly interventionist approach and choosing to focus on the job market’s slow recovery.

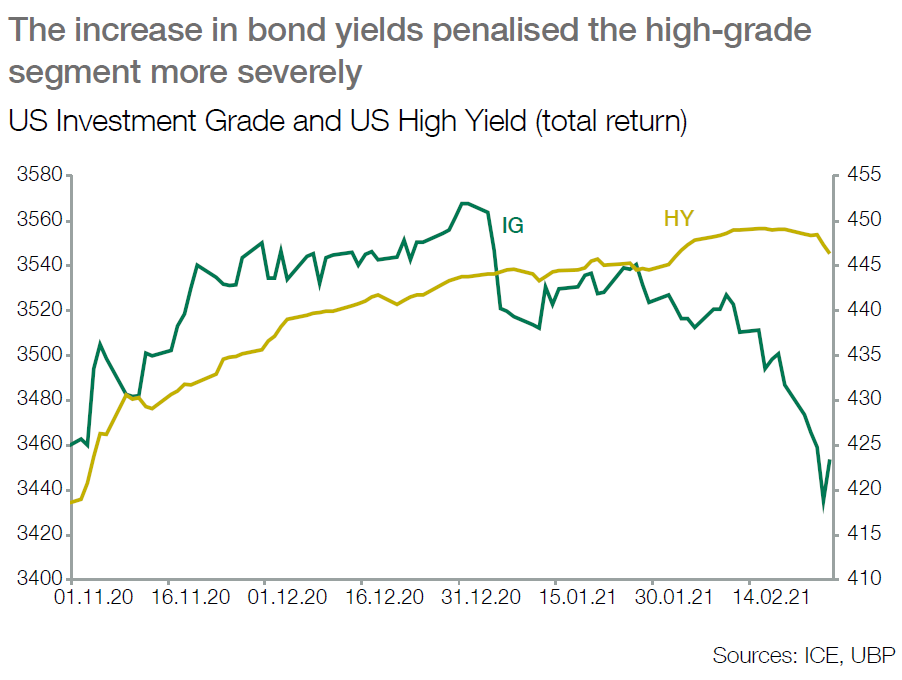

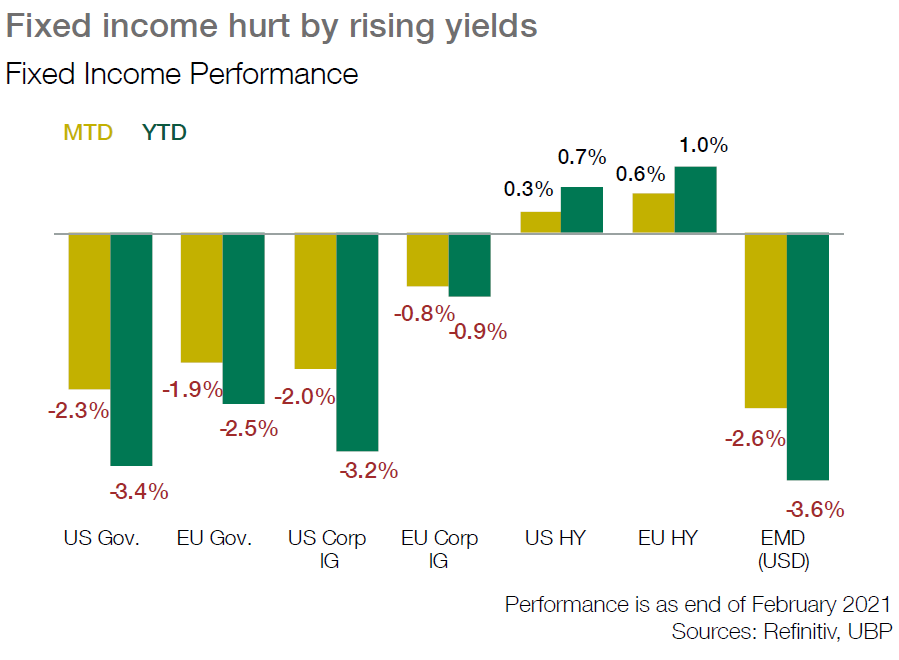

■ Strong economic growth fueled by government spending and an expansionary monetary policy suggest the prospect of a return of inflation, making low-yield bonds much less attractive. The increase in bond yields penalised the high-grade segment more severely where duration has been increasing as firms issue longer-dated to gain from the current low interest rate environment.

■ Nevertheless, spreads have continued to tighten over the month, reaching multi-year lows on the back of strong overseas demand amid the backup in sovereign yields and limited primary market supply. High-yield credit has been doing particularly

well helped by improving macroeconomic data and re-rating of sectors hardest hit by the pandemic.

■ The energy sector in particular could be a major tailwind for the overall US HY market. Improving corporate fundamentals and a positive medium-term outlook for crude oil prices suggest the energy sector could drive spreads temporarily tighter in the coming months.

■ While investor concerns about leverage ratios might have taken a back seat during the pandemic, frictions could start to appear in the medium term. For this reason, selectivity remains key with a focus on quality in the US and Europe and a preference for the high yield segment which offers a higher spread cushion and a lower duration.

■ With low/negative interest rates around the developed world, we believe Chinese government bonds and Asia credit are anchors to income-oriented portfolios looking into the remainder of 2021. With the dollar weakening story of 2020 set to continue in 2021, investors can also enhance returns via FX markets in the year ahead.

■ For higher risk appetite fixed income investors, European bank hybrid securities offer an attractive risk return profile and premium yields compared with European high yielding securities despite an implied backstop from the European Central Bank.

■ Going forward, however, as the near-term outlook remains uncertain and with medium-term stimulus on the horizon – investors can benefit from a ‘barbell’ strategy between lower risk, moderate duration strategies and cyclical recovery-oriented exposure looking to the 2H of 2021.