■ February saw US fiscal authorities take the baton from the Federal Reserve and surprise on the upside in terms of proposed spending programmes in the months ahead. This served as a tailwind for global equities and a headwind for global fixed income investors in the month.

■ While most expected Biden’s relief measures to be downsized from their original USD 1.9 trillion proposed level, excluding some modest changes, it appears likely that a good portion of the outsized spending will make it through in early-March providing dditional impetus to US growth.

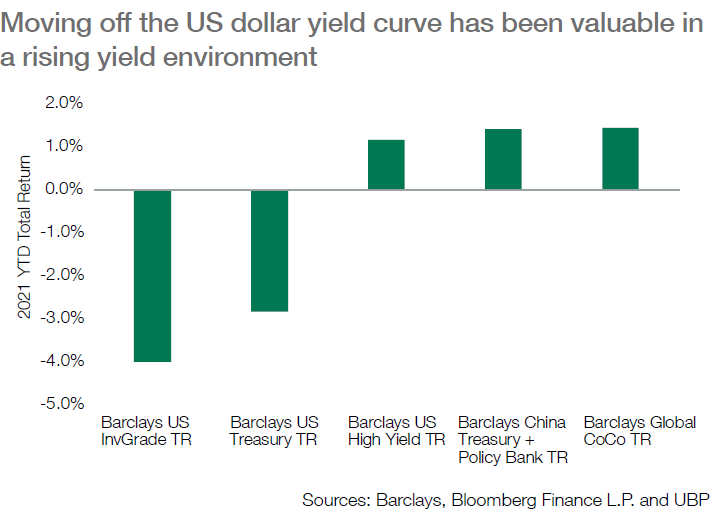

■ This fiscal optimism is proving a headwind for fixed income investors with US risk-free yields having breached the 1.5% level for the first time since the early days of the global pandemic. Credit investors found some shelter with spreads compressing. However, our short duration credit exposure in particular was a haven from rising yields.

■ Moving away from the US dollar yield curve has proven to be valuable as well. High carry supported our preferred European bank Coco position and a more stable rate environment domestically in China provided shelter from the USD interest rate volatility via China sovereign bonds.

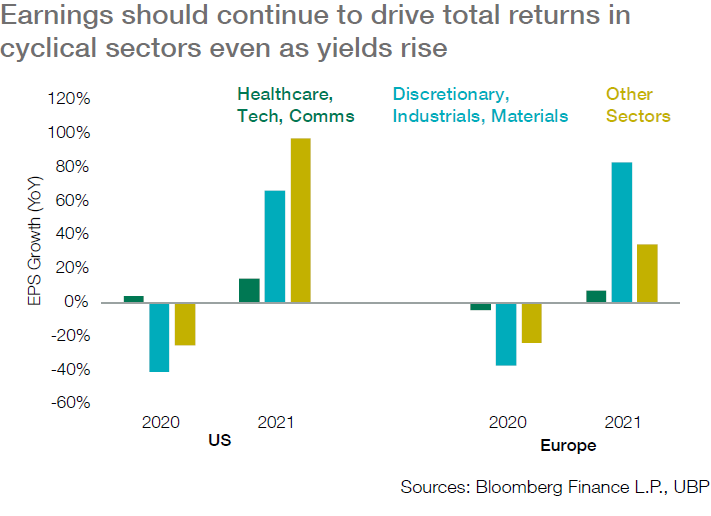

■ The fiscal impetus enhances what has already been a strong earnings season among US and European corporates where revenues beat expectations by over 2% in both locations and earnings by 16-21%. Earnings revisions across all regions of the world continue to track higher and we expect the acceleration to continue into 2Q2021.

■ Rising rates will be a headwind for elevated equity P/E multiples. However, we expect the accelerating earnings backdrop in aggregate as well as amongst individual companies and sectors to provide stock selection opportunities in companies with more durable valuation floors looking through mid-year.

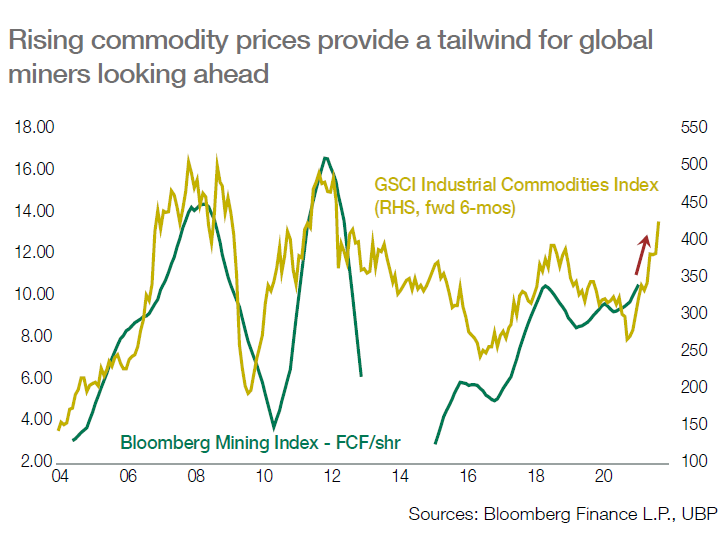

■ Indeed, earnings surprises combined with dividend hikes and an increased likelihood of share buybacks served as tailwinds for the cyclical/global mining leg of our equity barbell in portfolios. We added UK equites exposure in the month to provide additional cyclicality.

■ Though the rising yield environment has provided temporary respite in the broader US dollar bear market, with US fiscal spending set to accelerate once again, we expect renewed pressure on the US dollar to favour our preferred currency exposure in EUR, GBP and CNY as well as Australian dollar among cyclical currencies.