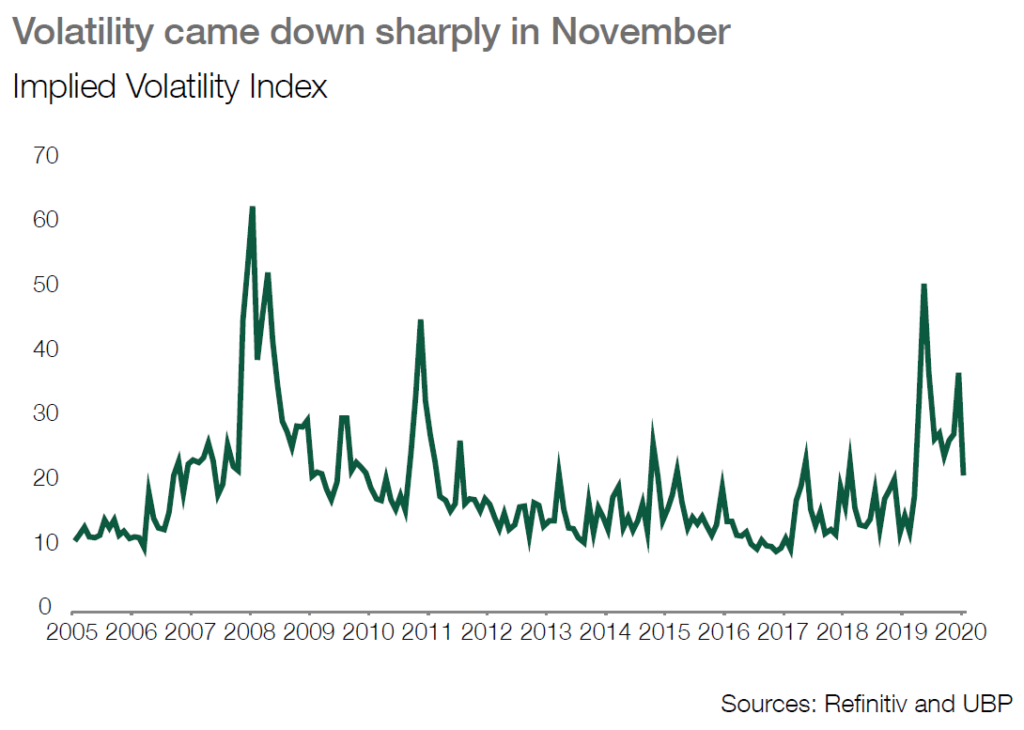

■ Throughout the year, we favoured asymmetric strategies including options, futures and long-short hedge fund strategies to shield portfolios well from the extremely volatile markets of 2020 while continuing to participate market upside.

■ Entering November, many of the risks that worried us began to dissipate with the earlier than expected vaccine announcements as well as the result of the US election.

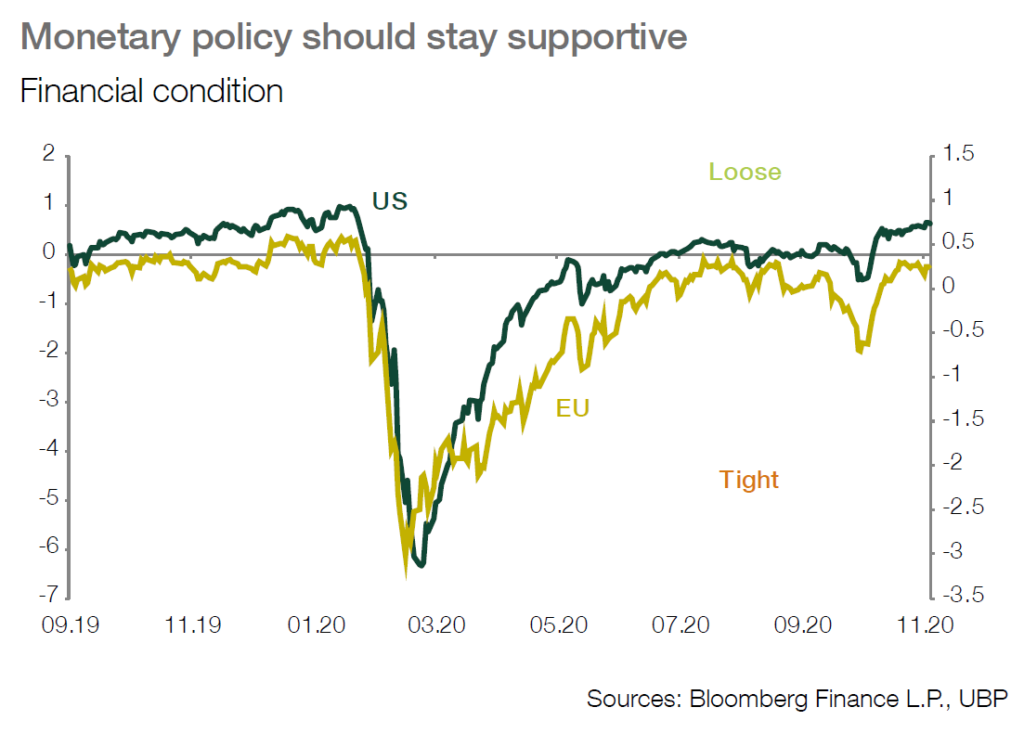

■ As a result, we started to exit our long-favoured asymmetry and pivot our portfolios to more directional strategies to accommodate the prospect of a 2021 cyclical rebound.

■ We exited our option and futures holdings as well as some hedge fund strategies.

■ Alongside our long-term transformation thematic such as technology, innovation and healthcare, we made a tactical allocation to European equities which should benefit from the expected cyclical rebound, given their relatively more cyclical nature.

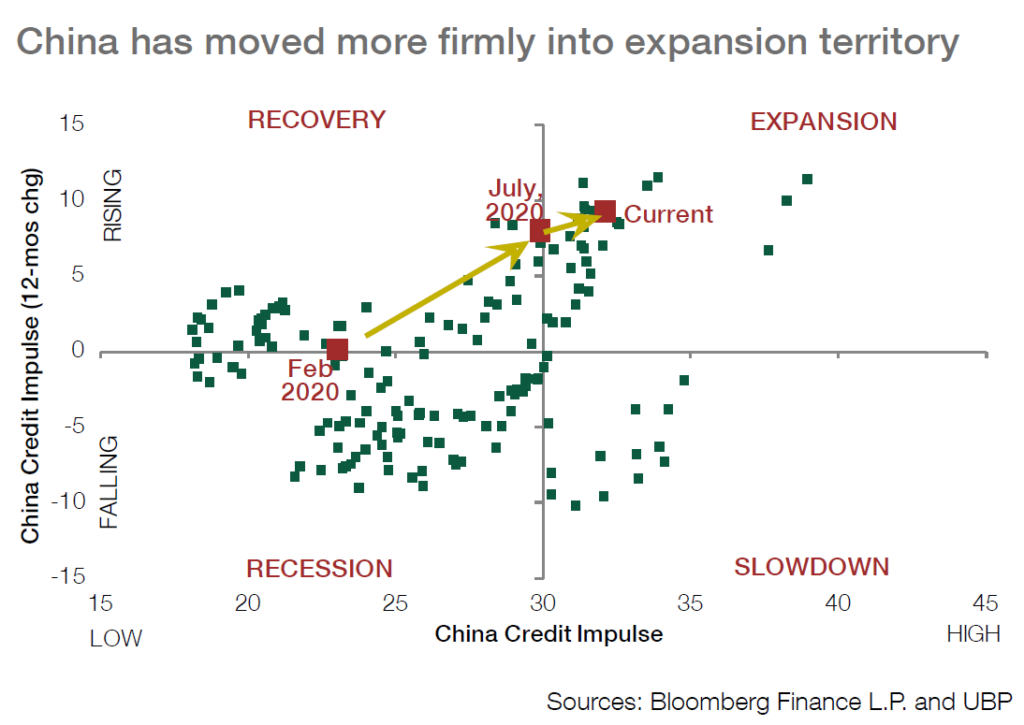

■ Last month, we rotated some of our US equity holdings into Chinese equity. With Chinese economic growth expected at 6.9% in Q4 and 8% for 2021 and a potential earnings upgrade, we believe the risk reward profile is attractive despite somewhat elevated valuations.

■ We are also assessing high quality value stocks. While the catch-up potential is appealing, we suggest a highly selective approach to avoid a potential value trap if only valuation metrics are used.

■ In the fixed income space, we are seeking to reinforce our credit exposure going into year-end. Selective high yield bonds, the European hybrid market as well as an expansion of our existing emerging and Asia credit are attractive looking into 2021.