Global economy / Asset allocation

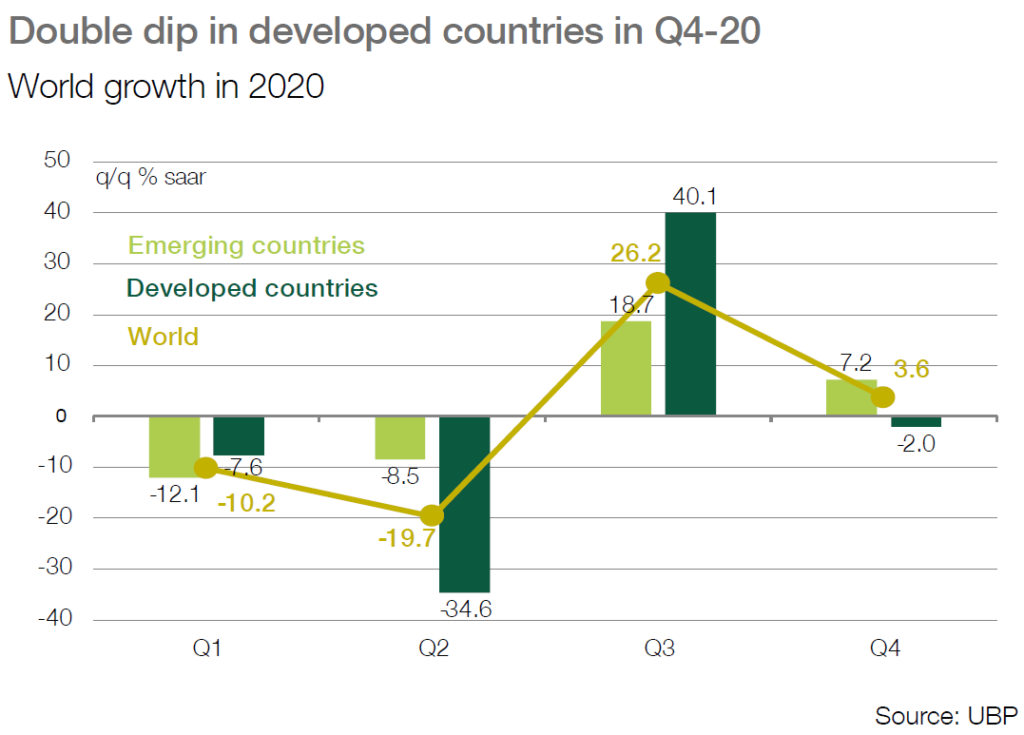

■ Global activity should continue to slow down in the

remainder of Q4, due to renewed lockdowns, with services the most impacted sector.

■ Europe, in particular looks like facing a double dip in Q4,

and a significant slowdown is also expected in the US.

However, more visibility on US politics, a gradual end to

European lockdowns and prospects of a vaccine should fuel a rebound in 2021.

■ Budgetary decisions remain in the pipeline, but appear to

be held back by political blockage in the US and the EU. In the meantime, central banks look set to continue reinforcing

their monetary support as 2020 ends to buy some time for

fiscal authorities to act.

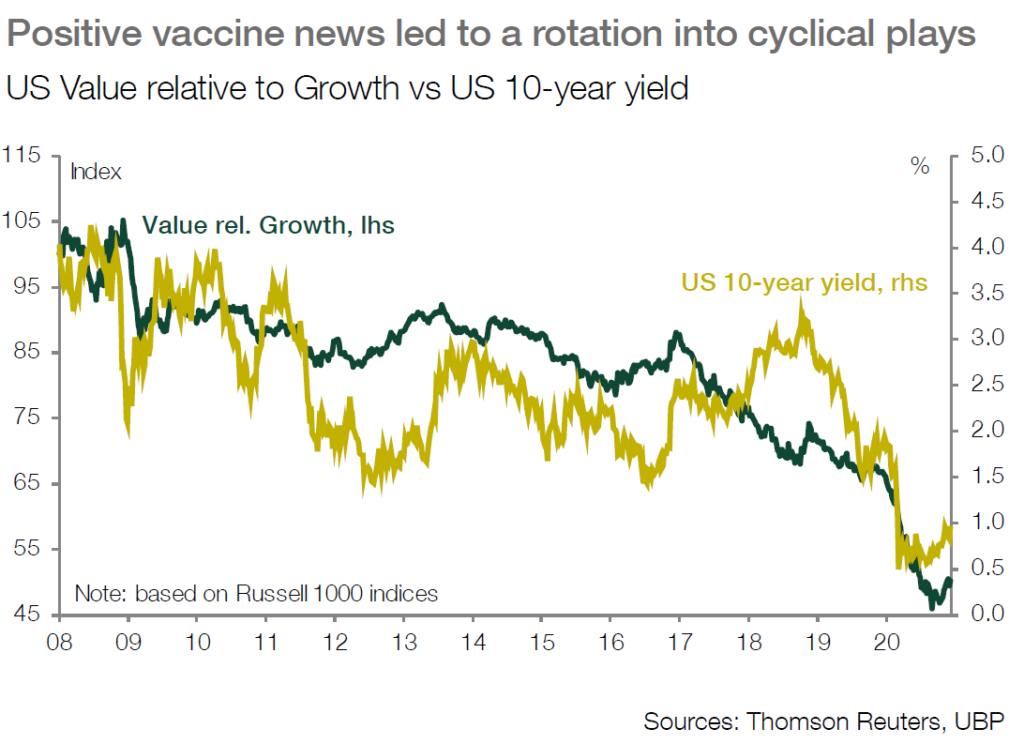

■ Despite the level of short-term uncertainty, we have pivoted portfolios to accommodate the prospect of a 2021 cyclical rebound.

■ As a result, we have shifted from previously favoured

asymmetric strategies to more directional strategies. We

exited our futures and options strategy as well as some

hedge funds to fully deploy our risk budget into equities. We seek to increase our credit exposure as well.

Fixed income

■ With the ECB signaling in its latest statement that it would

‘recalibrate its instruments’ at its December meeting, it may

indeed be looking to broaden its toolkit to include the high

yield bond market. However, should it not take that step,

investors are increasingly asymmetrically exposed to spread widening in the face of a continued default cycle on the continent.

■ The global environment strengthens the case for

outperformance of the emerging debt market. Existing

positions in Asia credit and Chinese government debt have

already benefited from the anticipation a global recovery as well as a weaker USD. We expect this trend to continue in

2021.

Equities/ Alternatives

■ We have added European equities in portfolios to benefit

from their greater exposure to key cyclical stocks and to

take advantage of expected EUR strength.

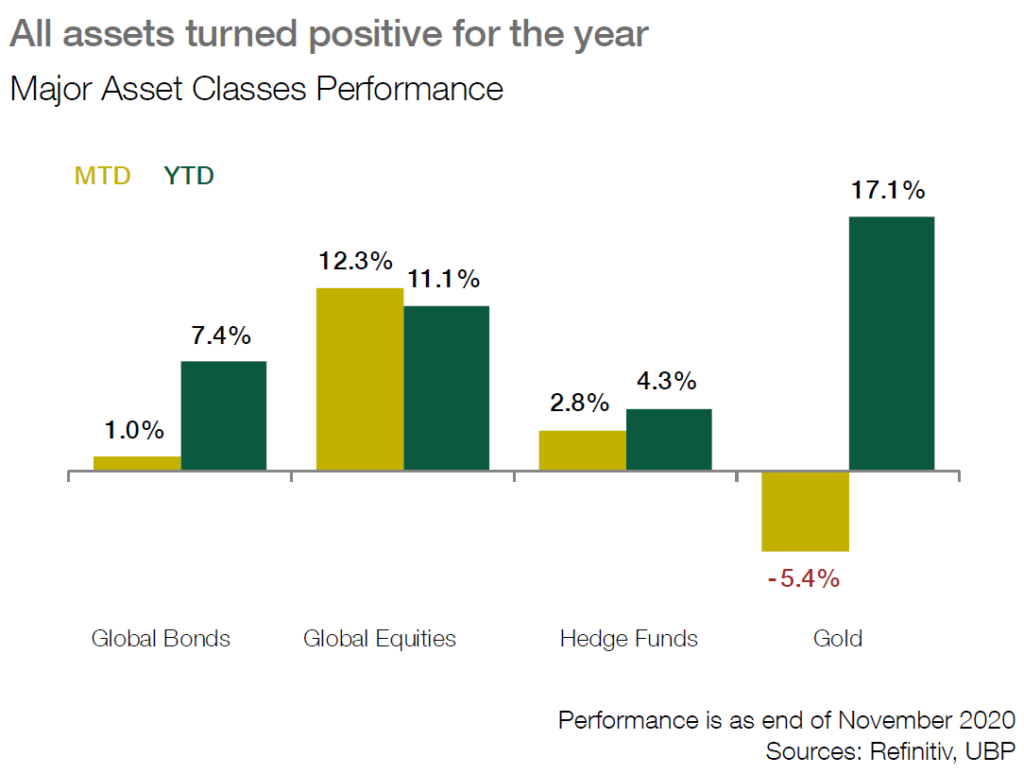

■ Gold continues to be favoured with interest rates

approaching zero and renewed monetary support expected in 2021.