■ Following the announcement of positive trial results on a COVID-19 vaccine and a reduction in US political uncertainty, sovereign bond yields rebounded in early-November before falling on the prospect of further global monetary easing at yearend.

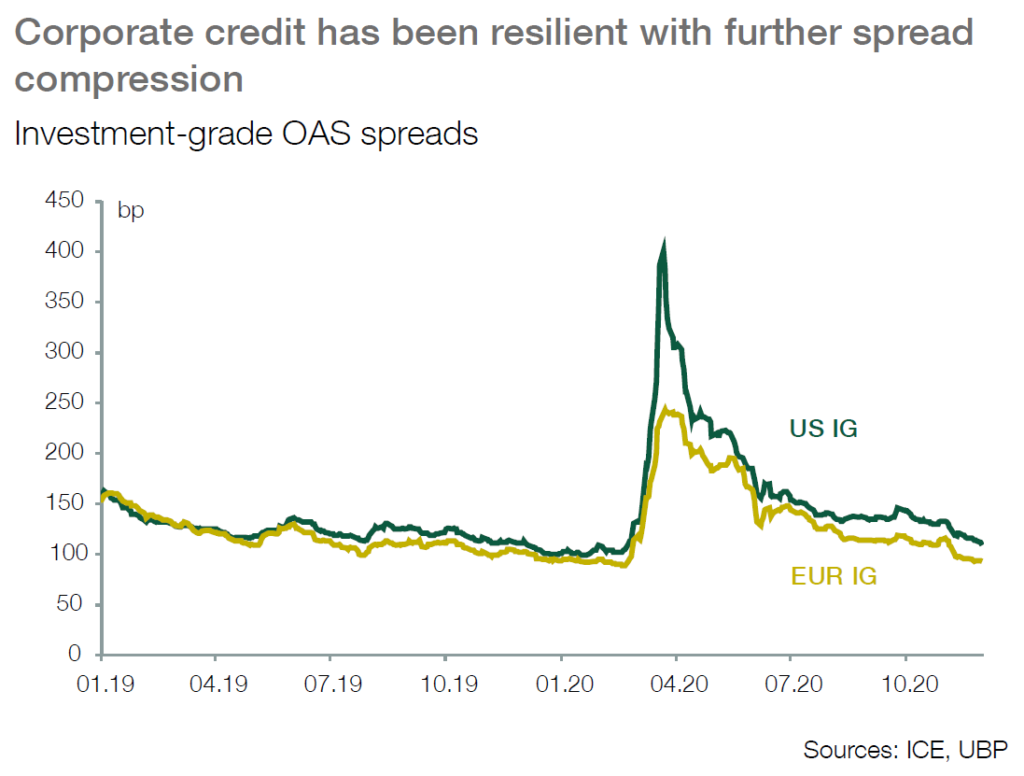

In contrast, corporate credit has been resilient with further spread compression despite a slowdown of credit flows.

■ Given the direct intervention of the European Central Bank in investment grade credit markets, the lack of movement with spreads near cyclical troughs is somewhat

understandable. However, with EUR high yield spreads still near post-pandemic tights, markets are either pricing in just a passing impact on overall credit quality or the prospect of the ECB following in the footsteps of the Federal Reserve by expanding its bond buying programmes to the fallen angel / crossover market.

■ With the ECB signalling in its latest statement that it would

‘recalibrate its instruments’ at its December meeting, it may indeed be looking to broaden its toolkit to include the high yield bond market. However, should it not take that step, investors are increasingly asymmetrically exposed to spread widening in the face of a continued default cycle on the continent.

■ In the US, commentary from Fed officials made a somewhat dovish pivot, as Powell indicated that the Fed may need to ease further. However, with the Fed unlikely to lower rates and policy guidance indicating they will remain low for years to come, extending the average maturity of asset purchases is the FOMC’s main option.

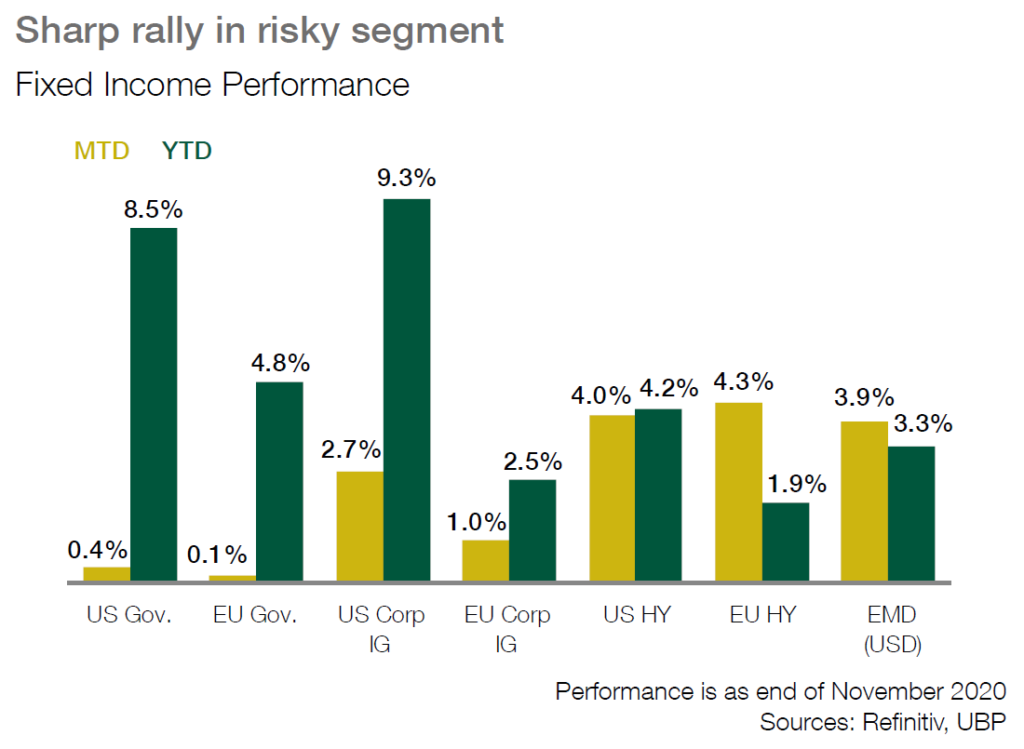

■ In credit, investment grade and high yield bonds have rallied.

Spreads are now approaching the tightest levels seen this year

despite the Treasury’s request to return unused funds meant to act as a backstop to five emergency lending programmes, including credit programmes. Nevertheless, the visibility provided by the vaccine timeline has allowed the market largely to shrug off this negative development.

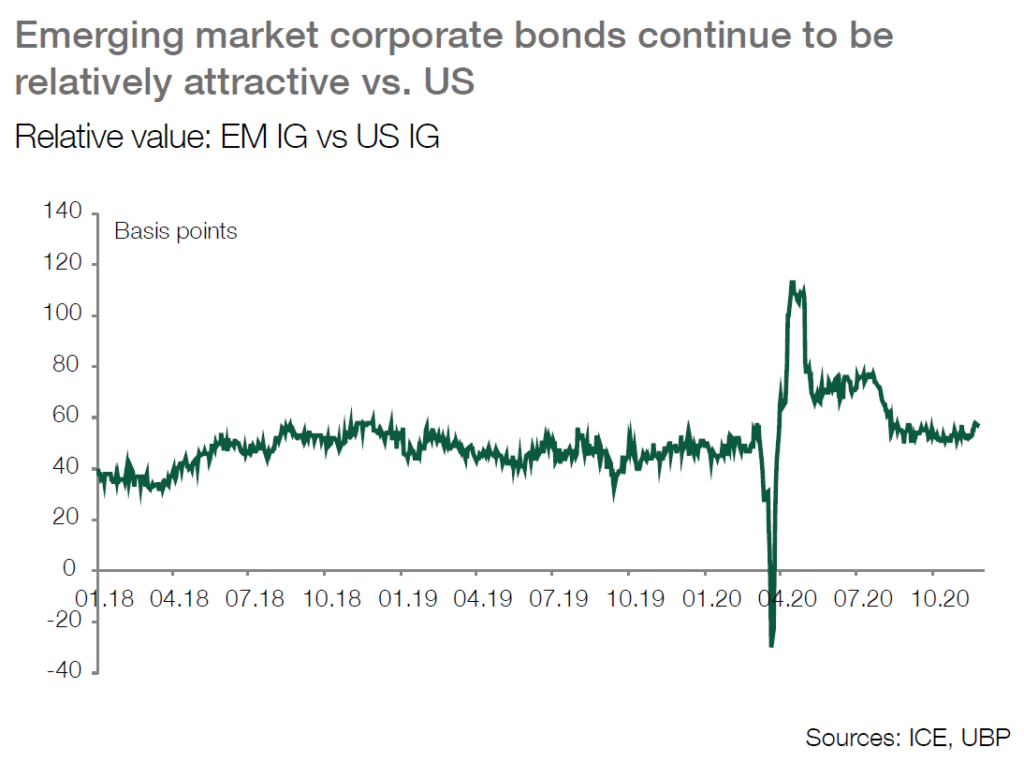

■ Looking forward, the global environment should remain

supportive for credit and strengthens the case for relative

outperformance of the emerging debt sector, notably in the Asia credit market which should benefit the most from a global recovery as well as a weaker USD.

■ The change in US administration is likely to add some ountryspecific

risk considerations, but overall should contribute to reduce uncertainty and lower volatility, favouring pro-cyclical and higher-yielding EM assets.

■ Existing positions in Chinese government bonds have benefitted

as well via the continued strengthening in the Chinese yuan.