New strategy fixed income into investment optimization

Union Bancaire Privée (UBP) establishes a new asset management unit in Taiwan, UBP Asset Management Taiwan Ltd (UBP Taiwan), having secured a Securities Investment Consulting Enterprises (SICE) business License, with the ability to serve as a Master Agent, from the Financial Supervisory Commission R.O.C (Taiwan) at the end of 2018.

Ted Holland, Chief Executive Officer Asia, Asset Management for UBP and Chairman of UBP Taiwan, expressed his confidence in the Taiwanese market. He said: ““The SICE license approval is a major milestone and achievement for UBP’s Asset Management strategy for the region. We are now fully set up with our own Master Agent business to service our institutional and intermediary clients in the Taiwanese market.” UBP has established a presence is Asia for more than 20 years and has worked with a number of joint investment companies in various regions from the management of business. At present, UBP has established companies in Hong Kong, Shanghai, Taipei and Tokyo.

Ted said:”UBP is located in every market environment, depending on the investment objectives of different resources and the situation of the risk design tailor-made investment portfolio. UBP has demonstrated its commitment and determination to support the responsibility of the community in the form of an investment that has been the responsibility of the Office of the Joint Venture (UNPRI). “ This year UBP launched the award-winning flagship fund – UBAM Global High Yield Solution (Dividend may be paid out of capital) Ted said: ”that the fund will be the focused fund for the next three years. It is expected to enhance the cooperation opportunities between UBP and various distributors in Taiwan to meet the investment needs of Taiwan investors.”

Slowdown in global economic growth, US-China trade, emerging market shocks and geopolitical tensions has let global investors to turn to low-volatility investment product, while relatively stable fixed income bonds have become the new favourites for investment. UBP advises investors to reverse the inherent investment thinking in the face of today’s global

turbulent economic trends.

Compared with the traditional bond funds of direct investment bonds, the high liquidity and low transaction cost of the new strategy are far superior. The new gain-investment strategy has the opportunity to provide investors with better returns and better protection in the face of uncertain future markets.

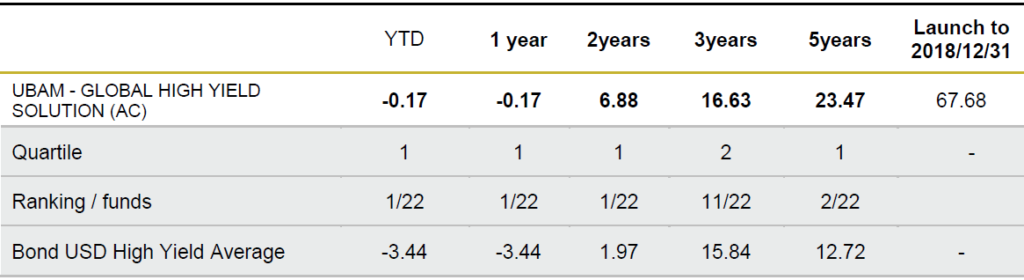

With a fund size of US$5 billion, the fund’s short, medium and long term performances are outstanding. It has received the highest rating in the Lipper Fund rating. The investment teams has taken the “up and down” strategy in investment portfolio, flexibly deploys the credit spread income and regional allocation, and assists investors to defend against market volatility and pursue stable returns with high liquidity and low transaction costs.

PERFORMANCE

UBP is one of Switzerland’s leading wealth and asset management bank, and is among the best-capitalised, with a Tier 1 capital ratio of 28.2% as at 30 June 2018. The Bank specialised in the field of wealth management for both private and institutional clients. It is based in Geneva and employs 1,724 people in over twenty locations worldwide; it held some CHF 128.4 billion in assets under management as of 30 June 2018. UBP Asset Management

Taiwan Ltd (UBP Taiwan), having secured a Securities Investment Consulting Enterprises (SICE) business License, with the ability to serve as a Master Agent, from the Financial Supervisory Commission R.O.C (Taiwan) at the end of 2018. UPB is able to provide more diversified financial solutions to investors. UBP aims to achieve sustainable business, build good professional knowledge environment, understand customer needs, based on facts and data, and provide financial products that best meet customer needs. For more information, please visit www.ubp.com