■ Stock and bond markets partially reversed their gains as renewed inflation concerns caused the divergence between risky and risk-off assets to close in February.

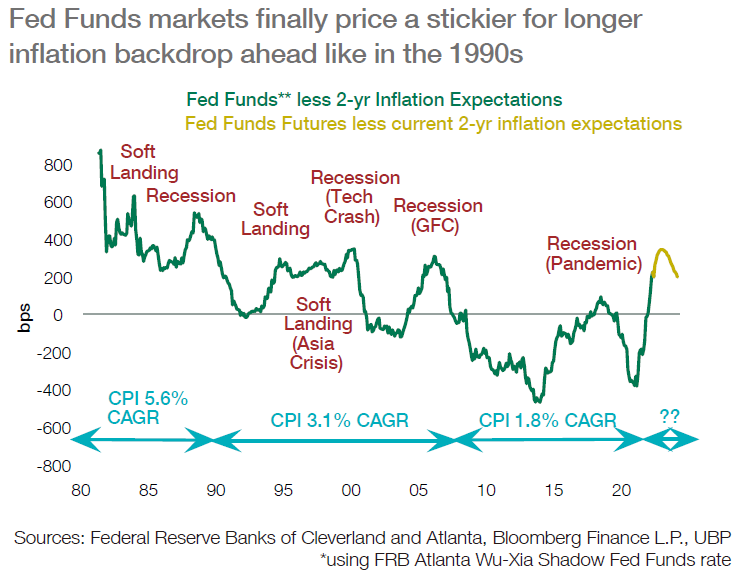

■ Stronger than expected US jobs and retail sales data paired with higher-than-expected inflation reports caused the recessionary rate cutting cycle previously priced to begin in 2H23 to be completely unwound. With further rate hikes now expected to continue through end-2023, this effectively discounts recession and instead looks towards ongoing economic strength.

■ This start to a convergence of expectations brought the volatility anticipated in January, allowing our hedge fund allocation to shelter portfolios from both the back-up in interest rates and the drawdown in equities in the month. We expect that the ongoing repricing of the growth/inflation backdrop will continue to bode well for our hedge fund allocation.

■ The February rise in US interest rates leaves markets pricing an environment of above target inflation for the balance of 2023, now more consistent with our forecasts for above target inflation through to year end.

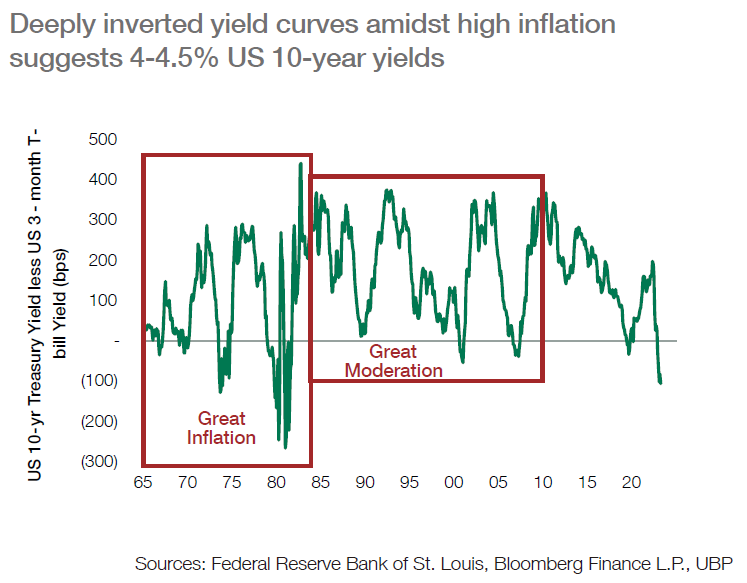

■ With the back-up in yields, we have closed our underweight USD duration exposure in portfolios. Admittedly, potential upside catalysts to inflation expectations likely remain. This suggests that further back-ups in US 10-year yields deeper into our 4-4.5% target should be expected. Were this to occur, combined with a rise in long-term inflation expectations to near 3%, it could provide another window to look to add to duration.

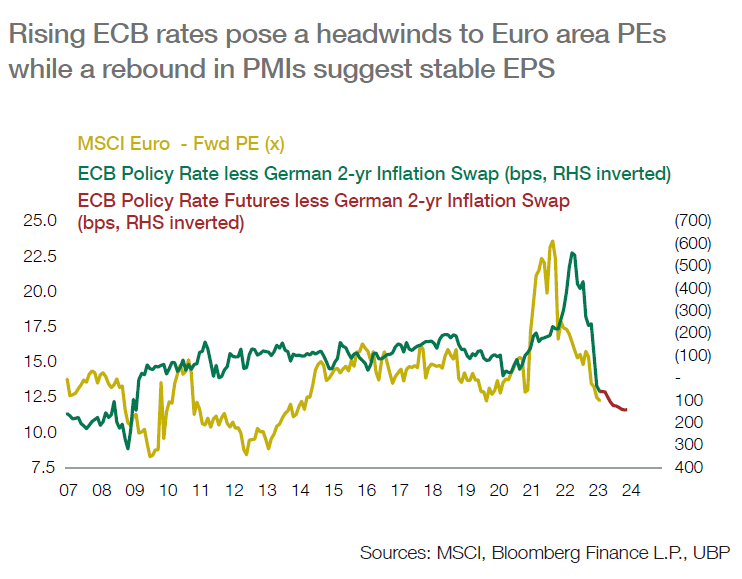

■ As markets continue to reprice growth and inflation expectations, we retain our cautious stance on equities as the deteriorating earnings picture has now been rejoined by rising real interest rates in the US and potentially in Europe as well in the months ahead. Just like in bonds, this repricing may offer tactical opportunities which agile investors may seek to exploit.

■ Such a tug of war between growth, inflation and policies is already unfolding in the Euro area where rebounding PMIs suggest that earnings expectations can stabilise while moderated by the headwinds posed by rising ECB rates.

■ Though upside surprises to growth and inflation have stalled the US dollar bear market in February, the prospect of upside surprises to policy rates and inflation in Europe leaves us seeking opportunities to add to long EURUSD positions looking ahead.