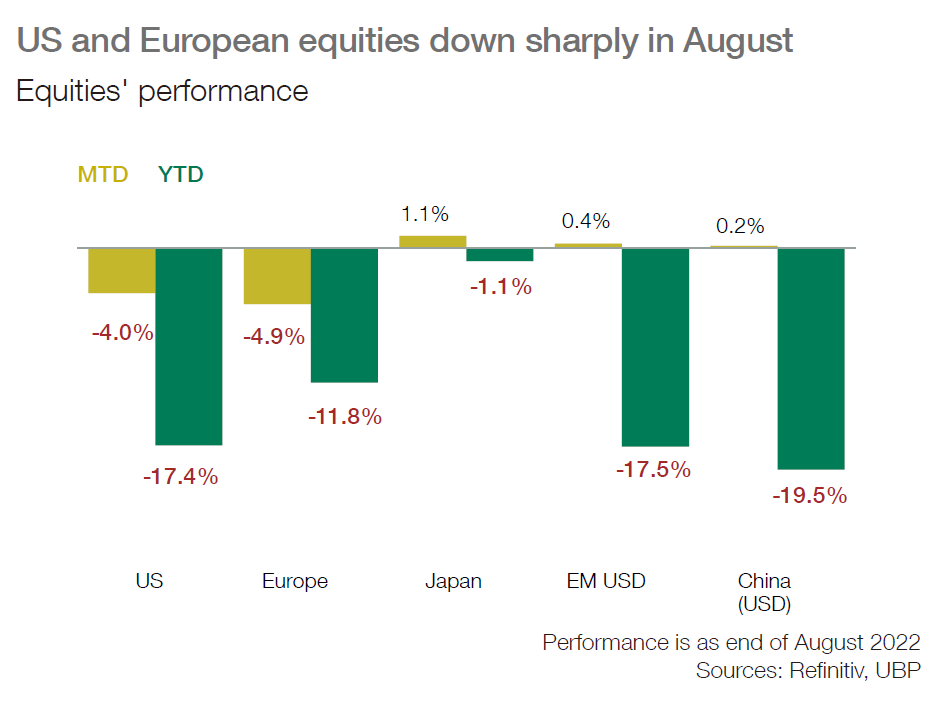

■ After a sharp rise since mid-June, reality caught up with investors at Jackson Hole, which reminded everyone that fighting inflation remains the central bank’s top priority.

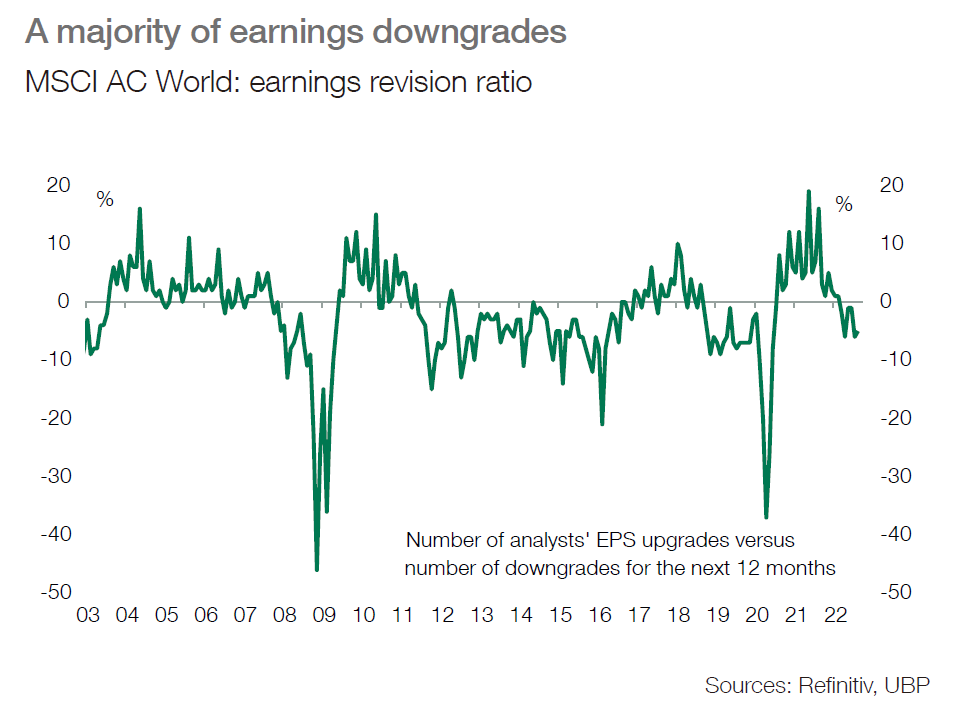

■ For US and emerging market companies, equity analysts have revised their earnings estimates downwards following the latest reporting season.

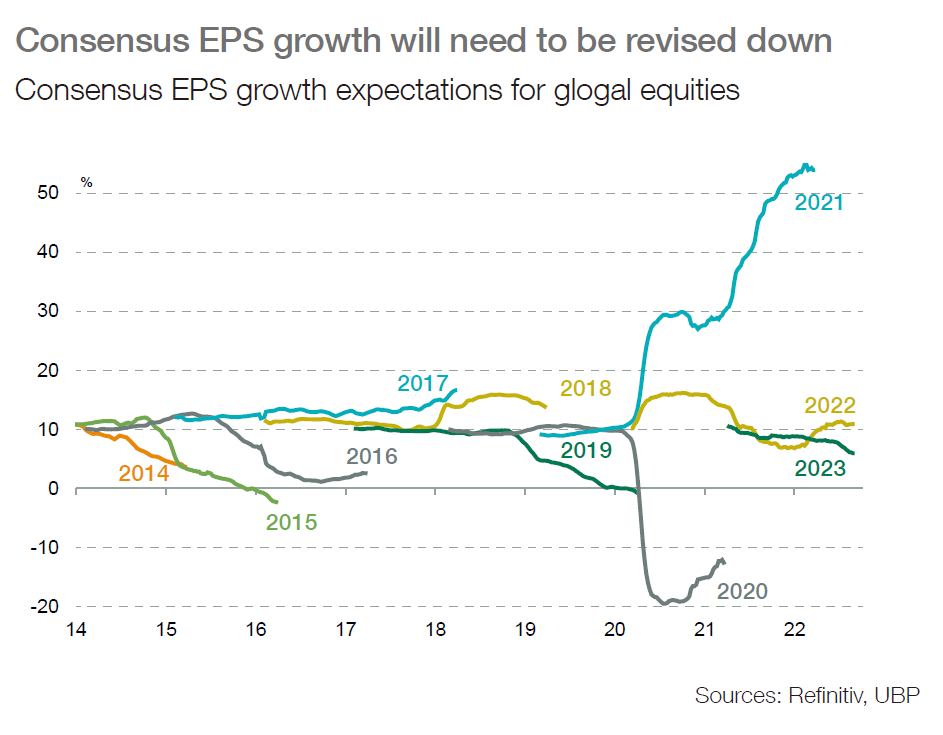

■ However, current consensus estimates are still a long way from reflecting the negative impact on corporate profitability arising from the meaningful slowdown in activity which we expect in the US and the likely recession in Europe.

■ Global earnings growth is still expected to stand at 11% in 2022 and 6% in 2023, which is way too high given our economic scenario.

■ In the US, S&P 500 consensus EPS growth forecasts for H2 fell to 6% from 11% over the last month. This means roughly flat EPS growth ex energy, which allows for some margin pressure given the still solid nominal growth rate. Ex energy, sales growth is forecast to rise by 7%.

■ In Europe, Q2 earnings finally grew by 30% (vs 15% expected two months ago). Ex energy, this growth rate fell to only 9% ex energy on a 16% jump in revenues. EPS are expected by the consensus to rise by 30% and 19% respectively in Q3 and Q4.

■ Since a slowdown in business activity, particularly in Europe, is inevitable in H2, it will become more difficult for companies to keep raising prices to defend margins at a time when raw materials, labour and energy costs still constitute big headwinds for firms.

■ 2022 earnings growth should stay modestly positive but, in our base-case economic scenario of a meaningful slowdown, profits are likely to decline next year while valuations need to compress further to reflect rising bond yields.

■ In this context, we therefore remain cautious on equities and keep our protection in various forms that we have implemented during the year.

■ Moreover, we continue to favour stocks with above-average visibility on earnings streams and well covered dividends.