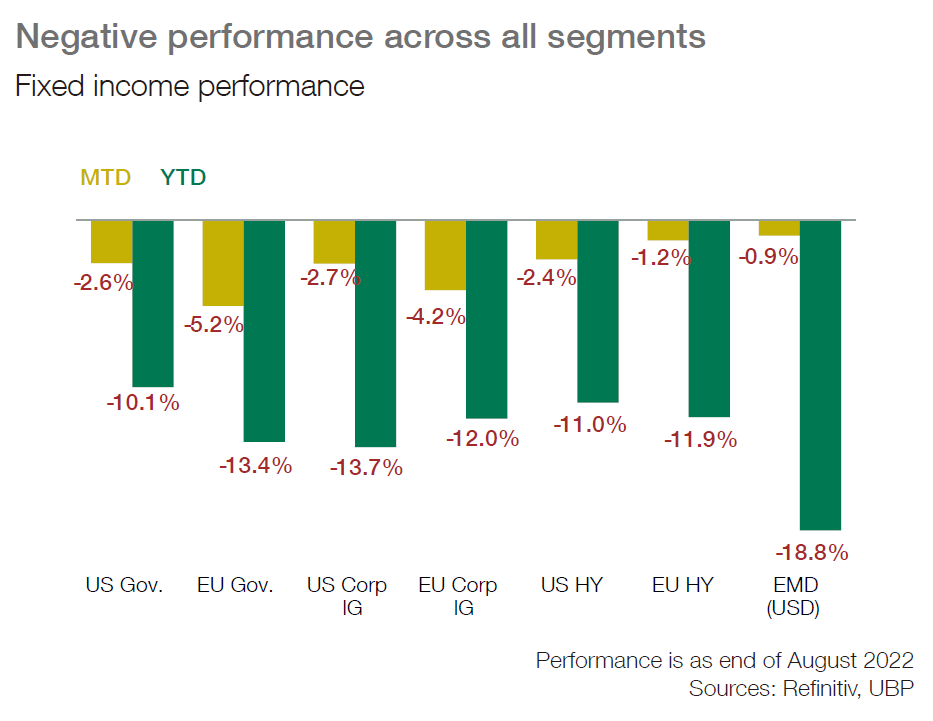

■ After their temporary decline in August, government bond yields have sharply rebounded on hawkish communication from US and European central banks and renewed inflation fears.

■ US 10-year yields have regained close to 3.30% early September after an easing to 2.6% by the end of July. At Jackson Hole, Mr. Powell confirmed the priority remained the fight against inflation. The risk of entrenched inflation justifies ongoing tightening in rates and Powell highlighted that no easing in policy should be expected in the short run as history suggests key rates must remain restrictive for some time.

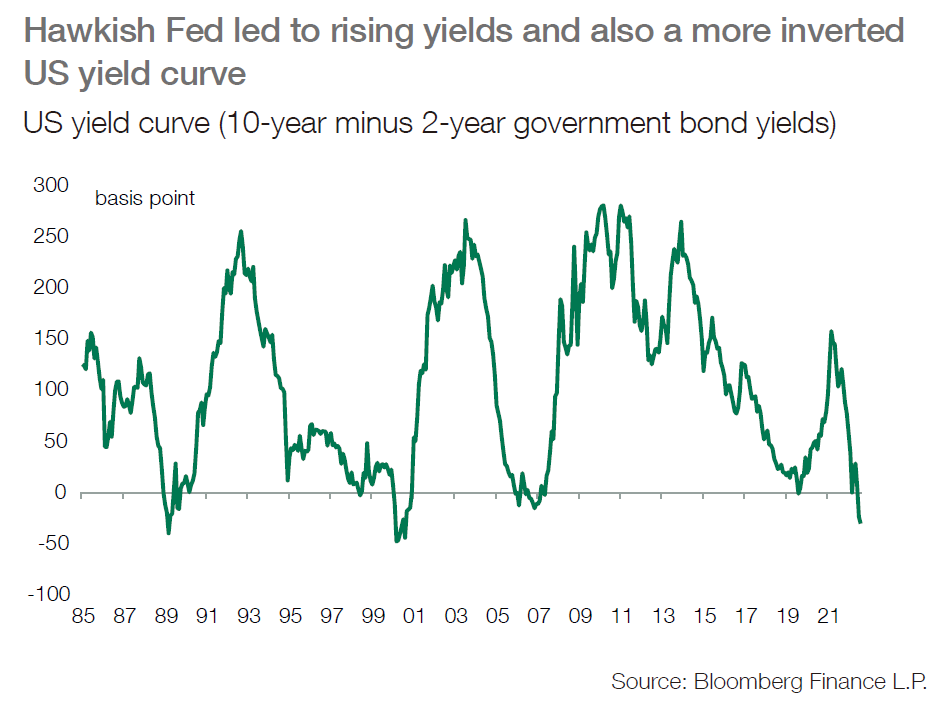

■ US rates have repriced a restrictive Fed policy and the US curve has inverted further; the debate on terminal rates, potentially close to 4% as mentioned by some Fed governors, has fuelled a rise in real interest rates while the Fed’s quantitative tightening (decline in its balance sheet), may add pressures on long bonds (upside risks to 3.5%-4%) and liquidity.

■ At Jackson Hole, the Fed reiterated its commitment to continue to fight inflation ahead of a new shock. Probability of a firmer adjustment in rates has increased after several governors adopted hawkish communication despite recession risks. In the eurozone, the risk of a renewed inflation shock, the reopening of primary markets and the uncertain political situation in Italy simultaneously puts pressure on yields and weakens the currency. The potential outcome of Italian elections fuelled a renewed rise in spreads versus Germany, while the ECB may wait before intervening in markets.

■ In major Western countries, government bond yields may renew with upside risks in the short run. With recession risks building, more opportunities may emerge later in government bonds, but volatility and risks suggest ongoing preference for short duration.

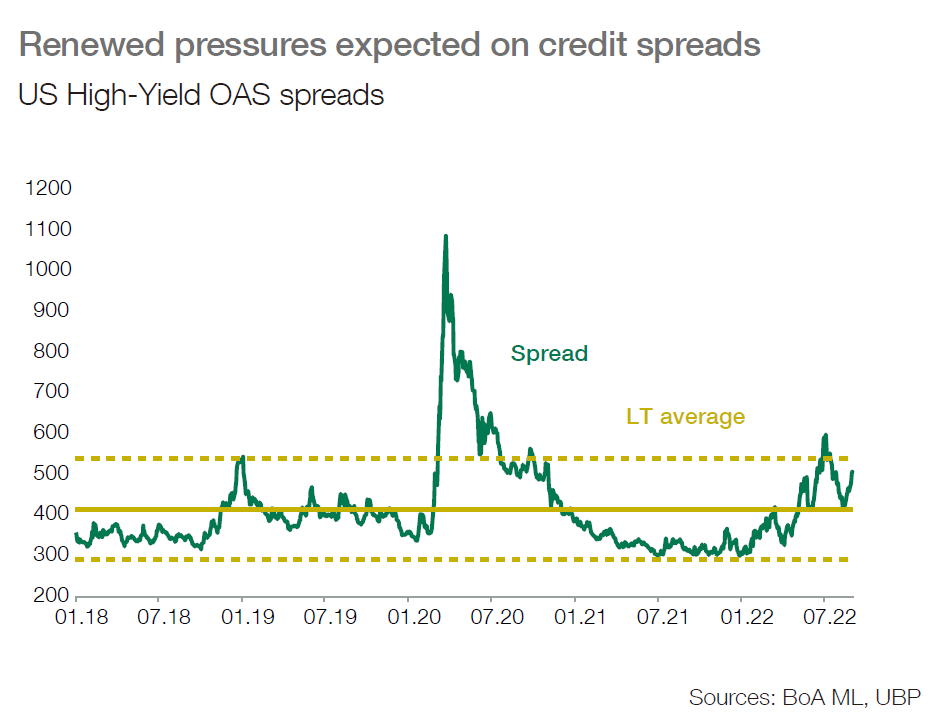

■ After some easing in August, credit spreads have widened and could face upside pressures in the next months. Spreads do not reflect recession risks and constraints from tighter monetary policy. Fundamentals could deteriorate in the US after Europe, leading to rising defaults. A cautious strategy remains in place with a focus on high credit quality and short duration positions. Preference also goes to some hedge fund strategies within the fixed income allocation.