Peaking inflation in the US

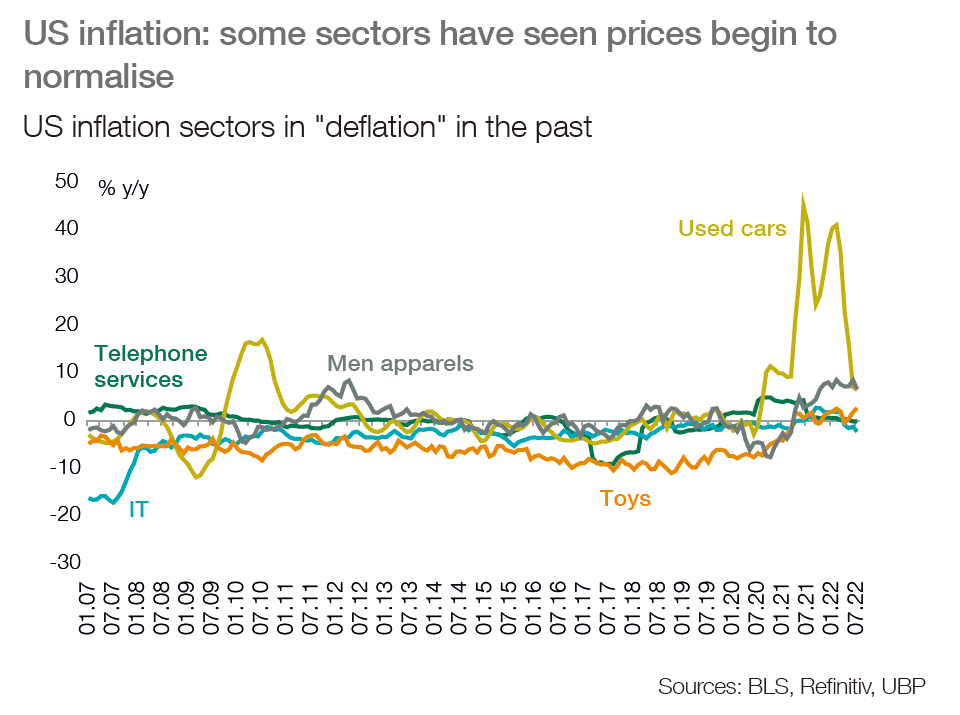

■ US inflation was flat in July and has declined on a yearly basis from 9.1% to 8.5% y/y; these outcomes resulted from falls in energy prices (-7.6% m/m) and declining prices in used cars, IT goods, airline fares and communication services. Nevertheless, food prices and rents remained on the rise.

■ Some sectors have shown initial steps towards a normalisation in prices after a large rebound due to strong demand after the lockdown. However, demand for some manufactured goods has eased with a rotation in favour of services.

■ Services remained on a rising trend; some price increases are fuelled by higher costs and wages; rents and medical costs are on a rising structural trend.

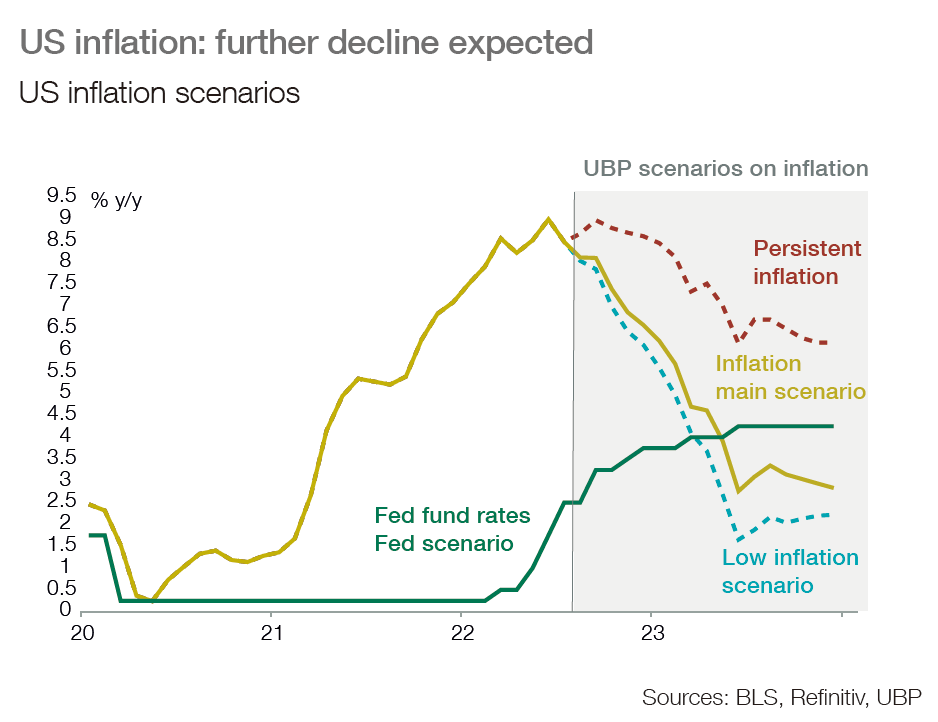

■ US inflation is expected to continue to decline in the next months, even with some volatility in energy. Headline inflation should reach 6.5% by year-end and should settle around 3% at the end of 2023. Core inflation should decline only progressively due to resilient service prices and rising wages.

■ US inflation data should offer a more comfortable pattern for the Fed over the next quarters. The picture is different in Europe which will face a new inflation shock in the months ahead.

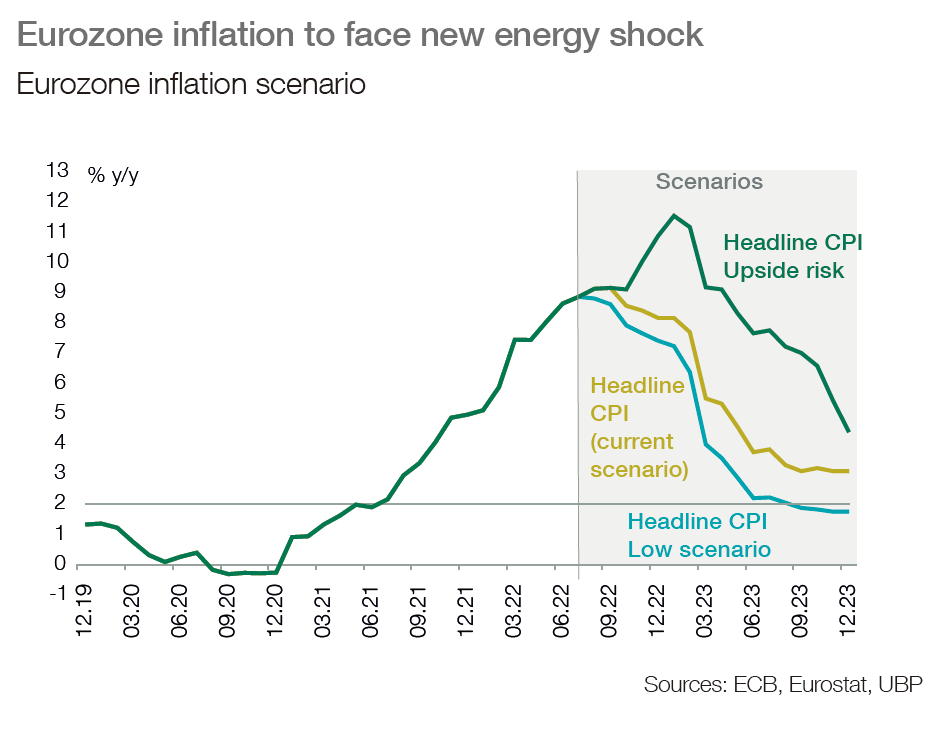

Europe: new inflation shock ahead

■ Inflation is expected to peak later, while a new shock should result from the surge in gas and electricity prices.

■ Headline inflation likely to push into double-digit territory in the UK and continental Europe at year-end. Food prices will continue to increase, reflecting ongoing shortage in grains related to the war in Ukraine-Russia. Food and energy prices represent more than 2/3 third of the recent rise in the yearly trend in eurozone inflation (9.1% y/y).

■ Prices of industrial goods appear to be shifting towards a normalisation with rotating demand in favour of services, but prices were sustained in tourism and leisure sectors.

■ Inflation in Europe may take a longer time to decline next year; some demand destruction likely to result, with rising pressures from consumers for higher wages and calls for more social support from governments.