Key points

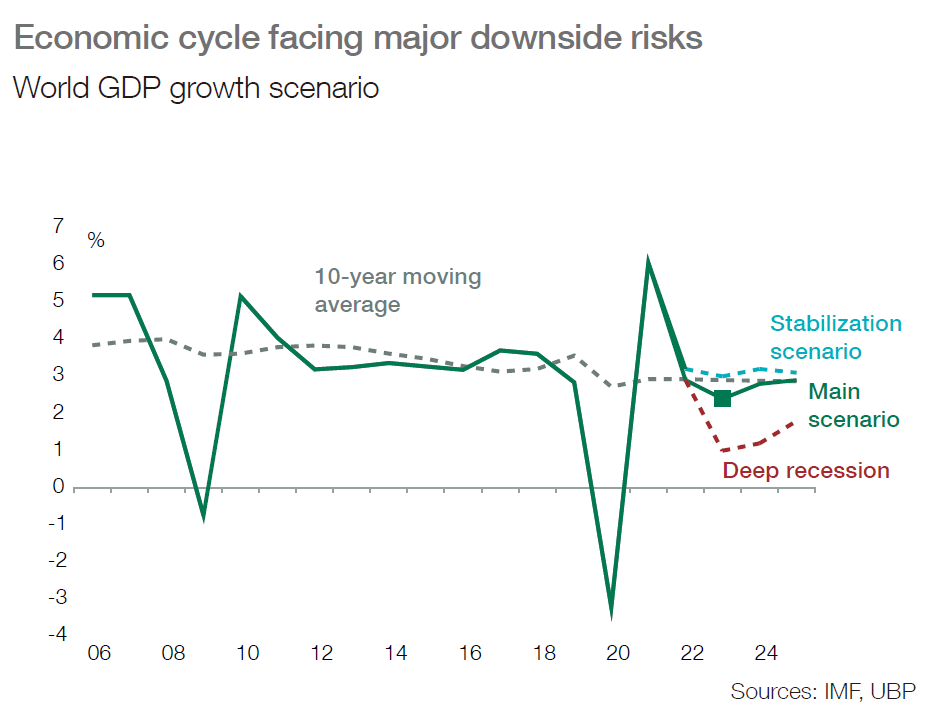

■ Tail risks to growth have increased further due to an energy crisis and severe tightening from central banks.

■ Global growth is fragile as the US and China face domestic challenges and fierce competition. Europe is facing a major energy crisis and a severe recession.

■ Inflation has peaked in the US and a progressive decline is expected in 2023; Europe expected to face double-digit inflation due to the surge in gas and electricity prices.

■ Monetary policy looks set to stay restrictive until inflation is under control. Central bankers looking to prioritise inflation versus activity and full employment.

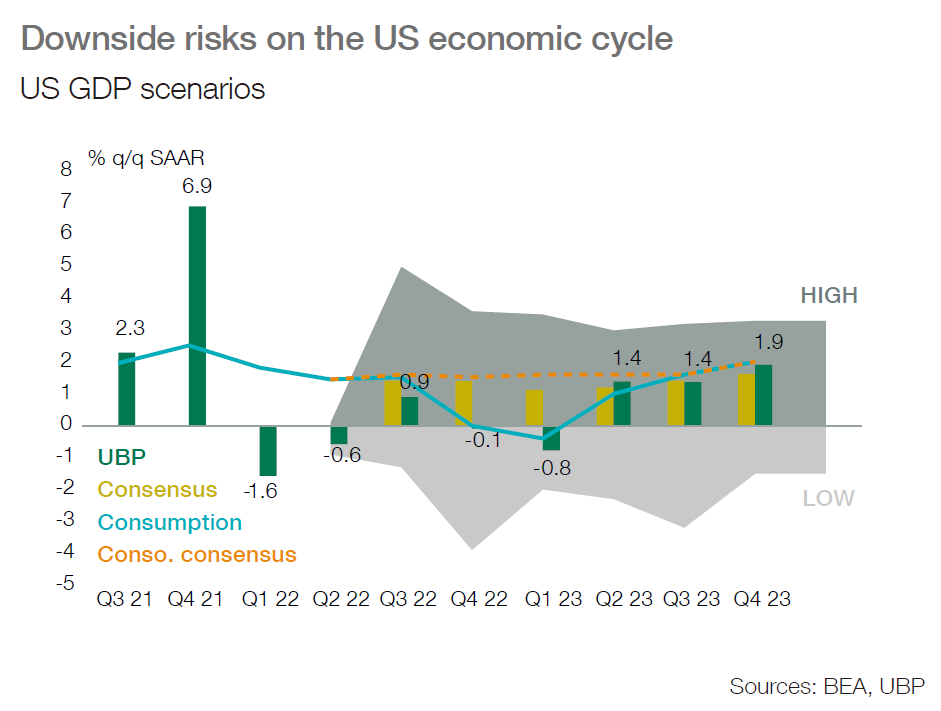

The Fed could push US economy into technical recession

■ US GDP has already contracted in H1-22, mainly due to slower inventory rebuilding. With weakening economic indicators, consumption should moderate further and, as the Fed wants monetary policy to be restrictive, risks are growing of a more pronounced contraction in domestic demand and of a technical recession in coming quarters. China: a slow recovery but it should gain more momentum later

■ Firmer activity is expected but several headwinds have slowed the recovery in Q3: renewed Covid cases and local lockdowns, a contraction in housing, and a power shortage due to a heat wave.

■ The central bank has surprisingly decreased key rates and injected liquidity to stabilise the property market. Fresh spending programmes on infrastructure and new technologies have also been launched. Eurozone is facing a major energy crisis

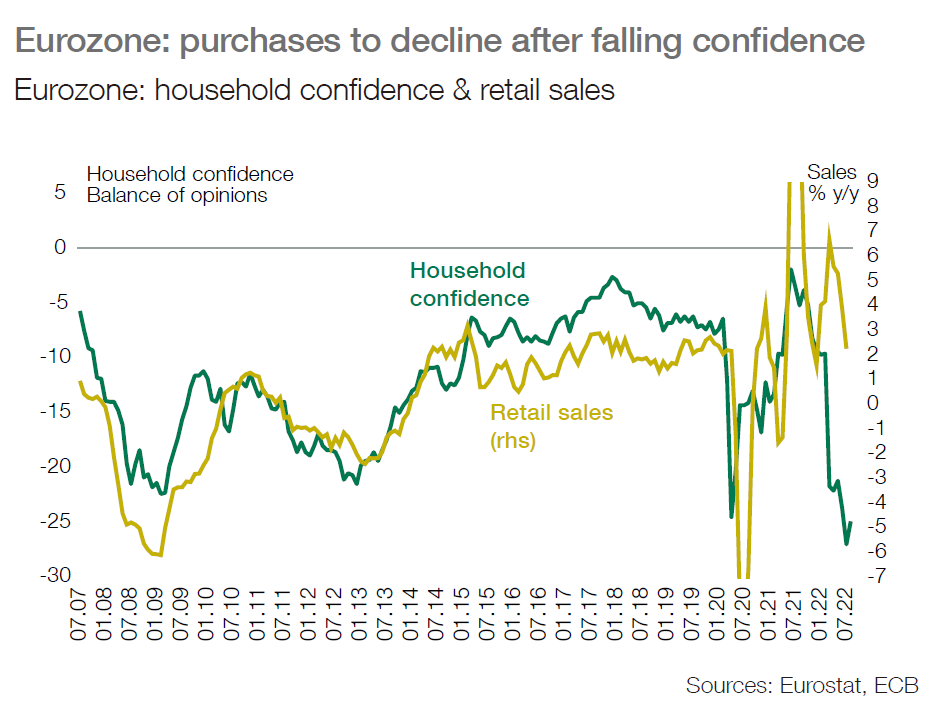

■ Europe is facing a major energy crisis; rising probability of a gas shortage from Russia forces governments to build inventories and to launch saving measures. Rationing of gas is not excluded this winter although its severity depends on weather conditions.

■ Activity is expected to contract at year-end with a recession following in Q1-23. Industry will be hit by energy shortages and consumption is likely to contract on deteriorating purchasing power. New measures are expected from governments to try to mitigate this latest shock.