Global economy / Asset allocation

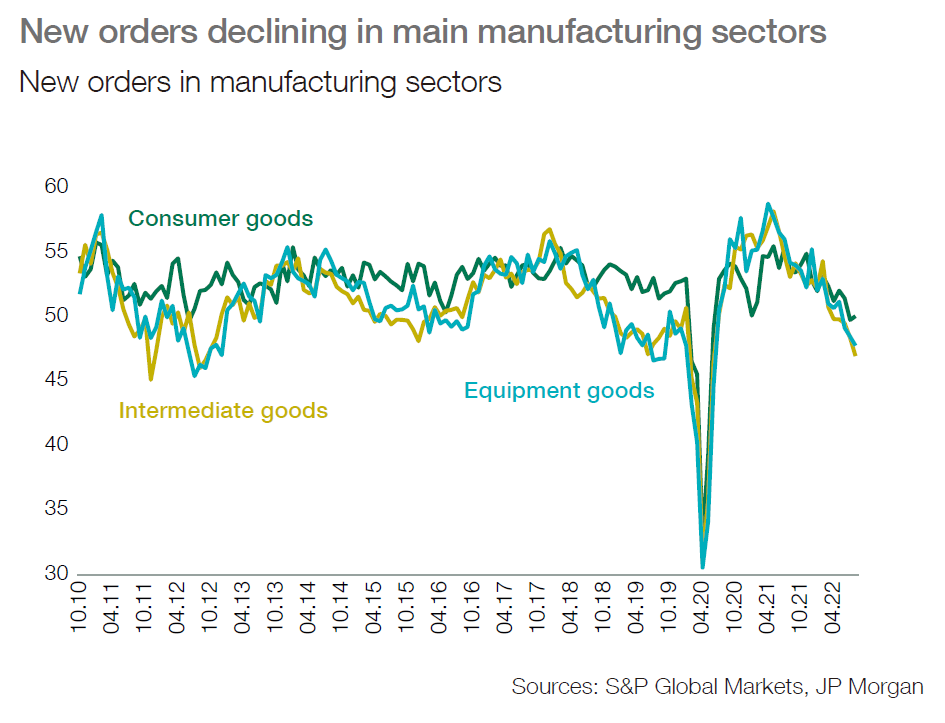

■ Activity is slowing down in the US, while recovery in China remains slow; Europe is facing accumulated recession risks as it heads towards winter.

■ US inflation has peaked, and a further progressive decline is expected, while inflation in Europe should accelerate further due to the energy crisis.

■ Central banks should continue to hike key rates aggressively as inflation remains their top priority despite signals of a sharp slowdown.

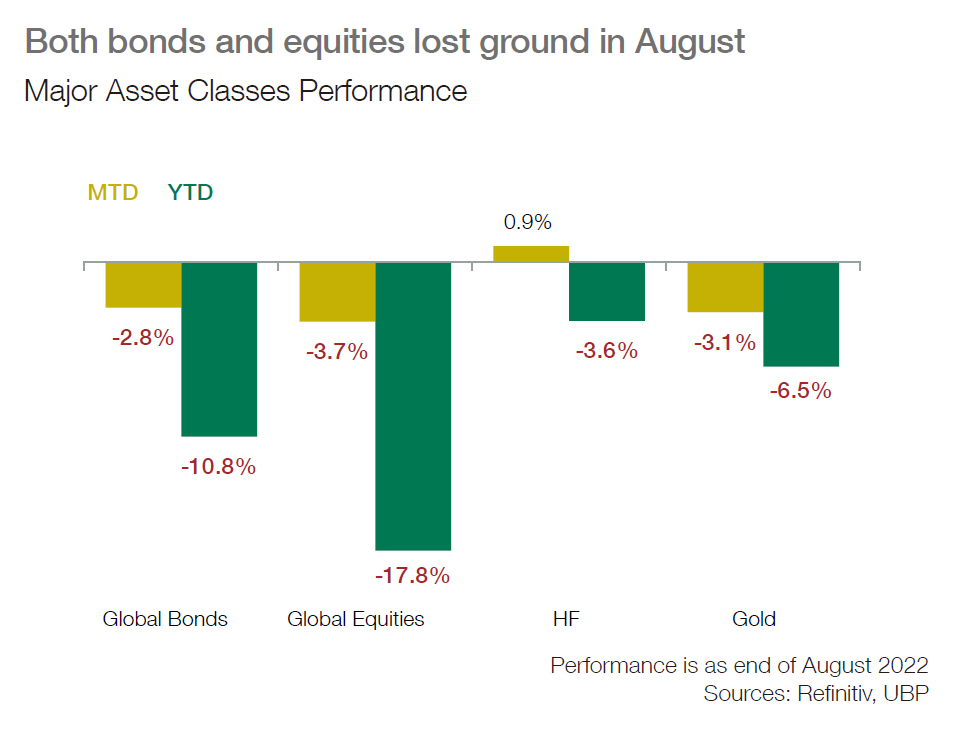

■ As a result, despite the rally in July and August, we remain cautious on risky assets. We continue to favour quality both in fixed income and equity allocations. Companies with strong balance sheets and high earnings visibility should outperform going forward.

■ Elevated cash levels, structural products and alternative strategies remain key to maintaining asymmetry in portfolios.

Fixed income

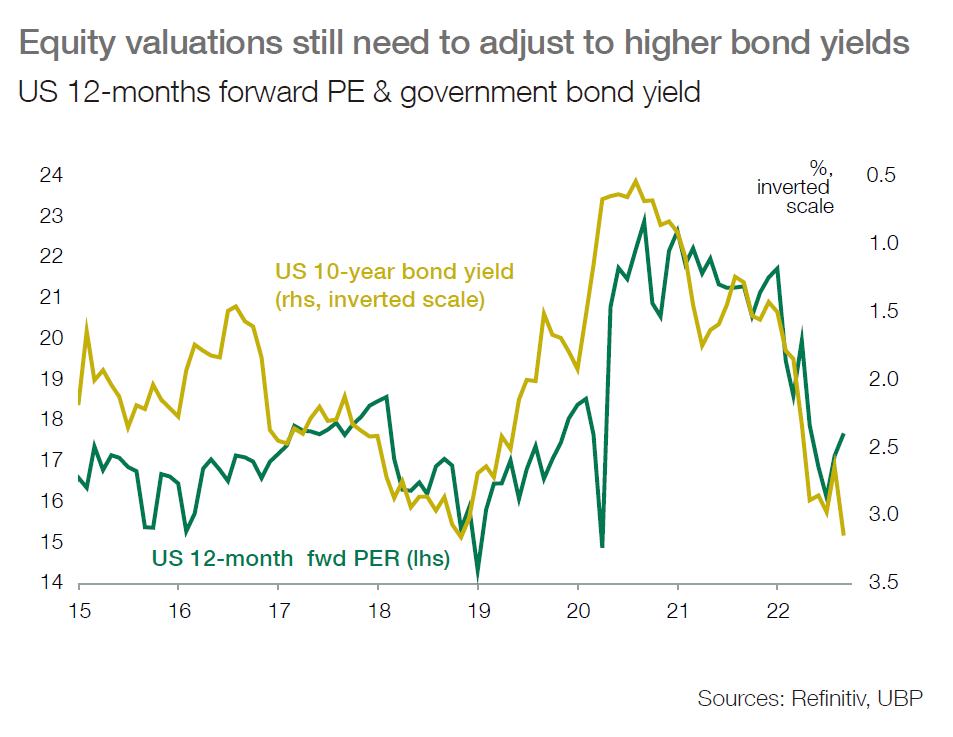

■ Government bond yields have rebounded on prospects of a more severe tightening from central banks.

■ US 10y treasuries face renewed upside risks (potential 3.50%-4%) on a more restrictive Fed policy with no pivot in strategy in sight. Credit spreads remain low and do not reflect probable deterioration in activity expected in both the US and Europe.

■ Short duration investment grade corporate bonds and hedge fund strategies remain preferred within the fixed income allocation.

Equities

■ Earnings estimates will most probably need to be cut substantially to reflect our scenario of a meaningful slowdown in activity in the US and a likely recession in Europe. Moreover, valuations need to compress still further to reflect the rise in bond yields.

■ Alternatives

■ Select short hedge fund strategies present useful asymmetric exposure, protecting portfolios against any earnings and credit quality risks in equities and credit.