■ Following the summer rally, risk assets once again overprice soft-landing prospects requiring a cautious stance on the part of investors going into year-end. Comments from Fed Chair Powell suggest that economic risks are increasingly skewed towards recession especially in Europe and the US in the months ahead.

■ Though the inverted Treasury yield curve already anticipates a 2023 recession, ongoing Fed rate hikes suggest that US 2-year yields may rise to 4%. Even with the 10-year yields trading below 2-year yields during recessionary periods of the Great Inflation, it suggests that at 3.3% currently, the risk to 10-year yields is skewed higher in the months ahead towards 3.5-4.0%

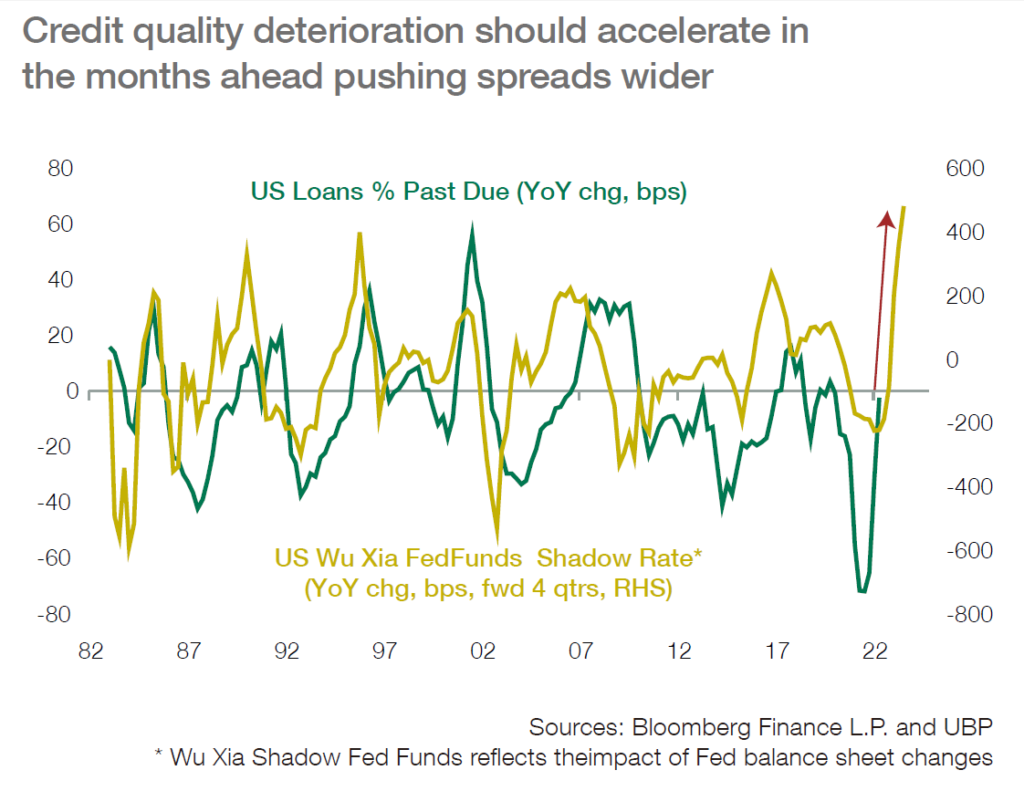

■ The summer rally in credit markets has unpriced the recessionary spreads seen in June, 2022. The prolonged Fed tightening cycle seems to indicate that investors will begin to see credit quality deterioration accelerate in the months ahead, as has been the case at this stage of the tightening cycle since the early-1980s.

■ As a result, we remain short duration biased in bond portfolios with a quality focus within credit. We continue to use alternative fixed income strategies to cushion against the prospect of upside surprises to yields (as in 1H22) or more disruptive moves in credit spreads looking forward.

■ In equities, with PE multiples having moved above prepandemic averages and despite 10-year Treasury yields resuming their march higher, investors are facing a backdrop that has parallels to 1H22 as equity markets may need to once again reprice a higher yield environment.

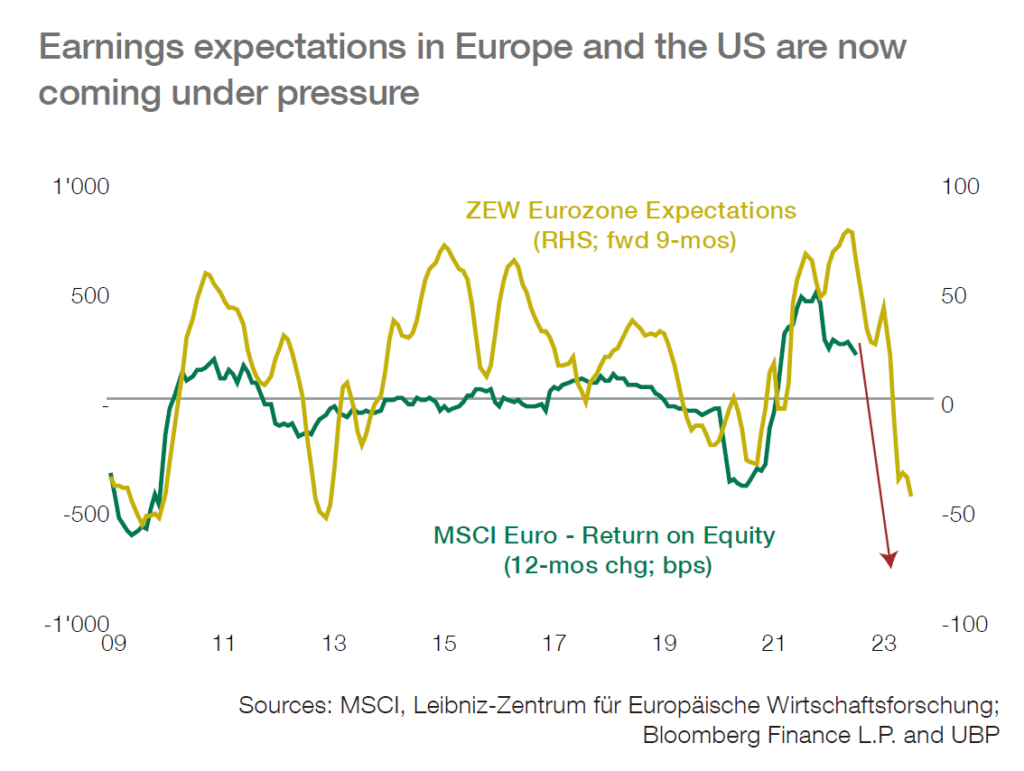

■ This time however, investors will not be able to lean on the strong earnings growth that characterised corporate profits in 1H22. Instead, downgrades to 2H22 and 2023 earnings have begun even amidst the ‘as expected’ earnings season which just ended.

■ Consequently, we expect our structured product and options strategies to help cushion portfolios against the two-pronged headwinds of falling PE multiples and earnings expectations looking into 2023.

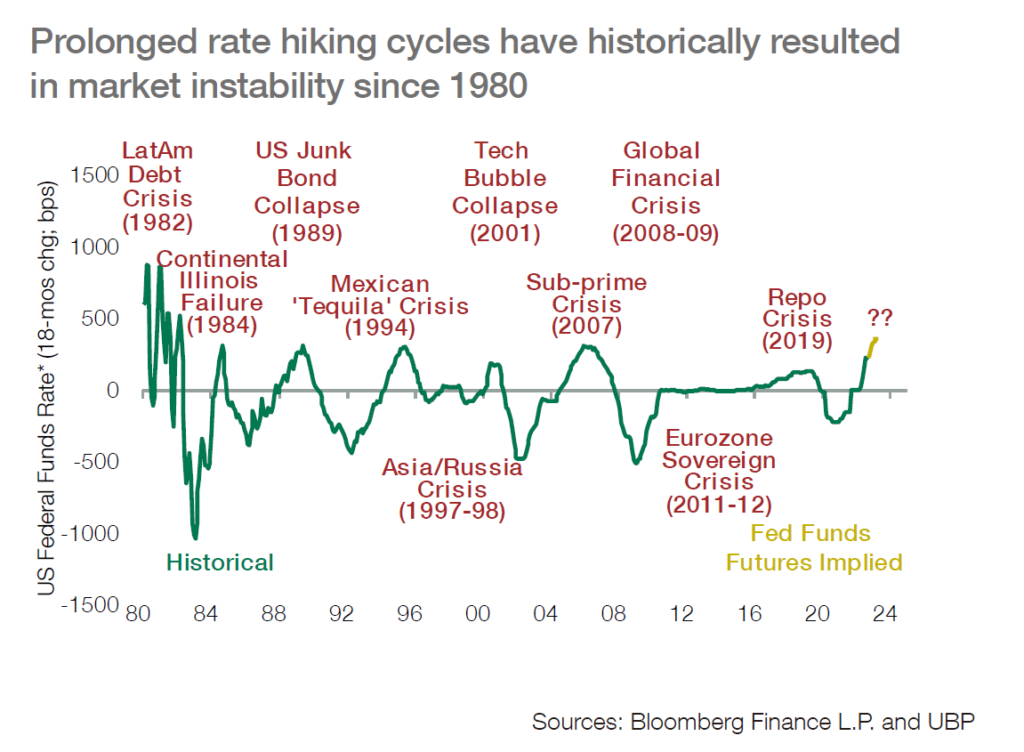

■ Investors should likewise be aware of the rising risks of market dysfunction. With global financial conditions already cyclically tight with no signs of policy easing ahead, prolonged Fed tightening cycles have preceded meaningful, disruptive shocks since the early-1980s.