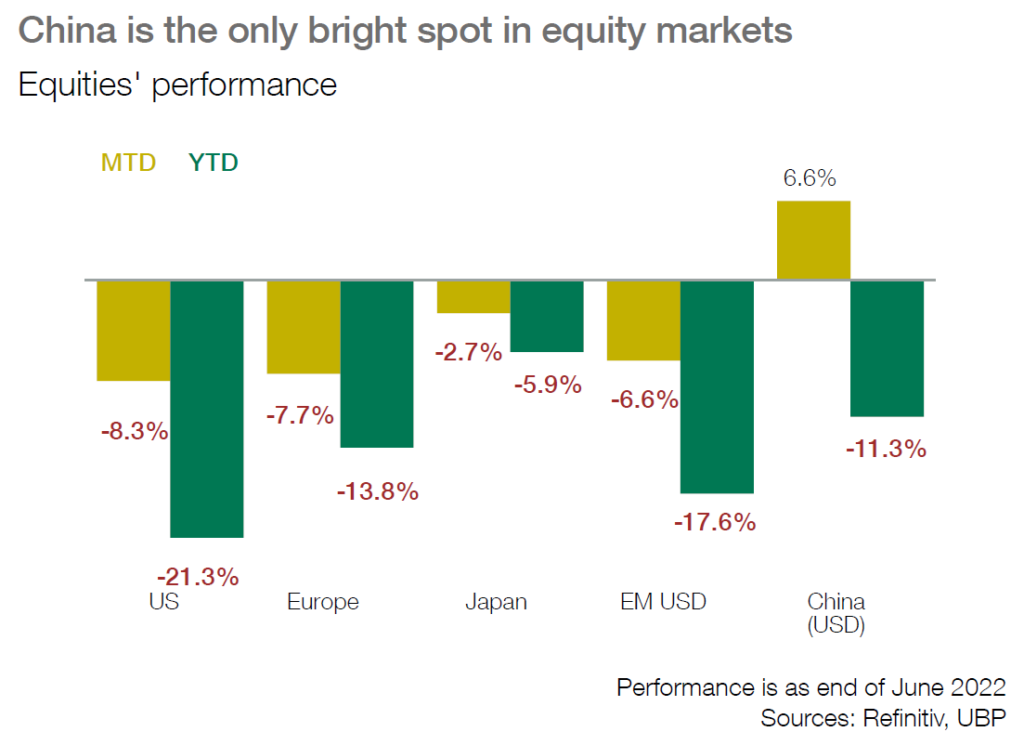

■ June was another tough month for equities with investors increasingly concerned about a recession due to disappointing economic data, higher-than-expected inflation, ongoing hawkish central bank rhetoric and the threat of a Russian gas cut-off in Europe.

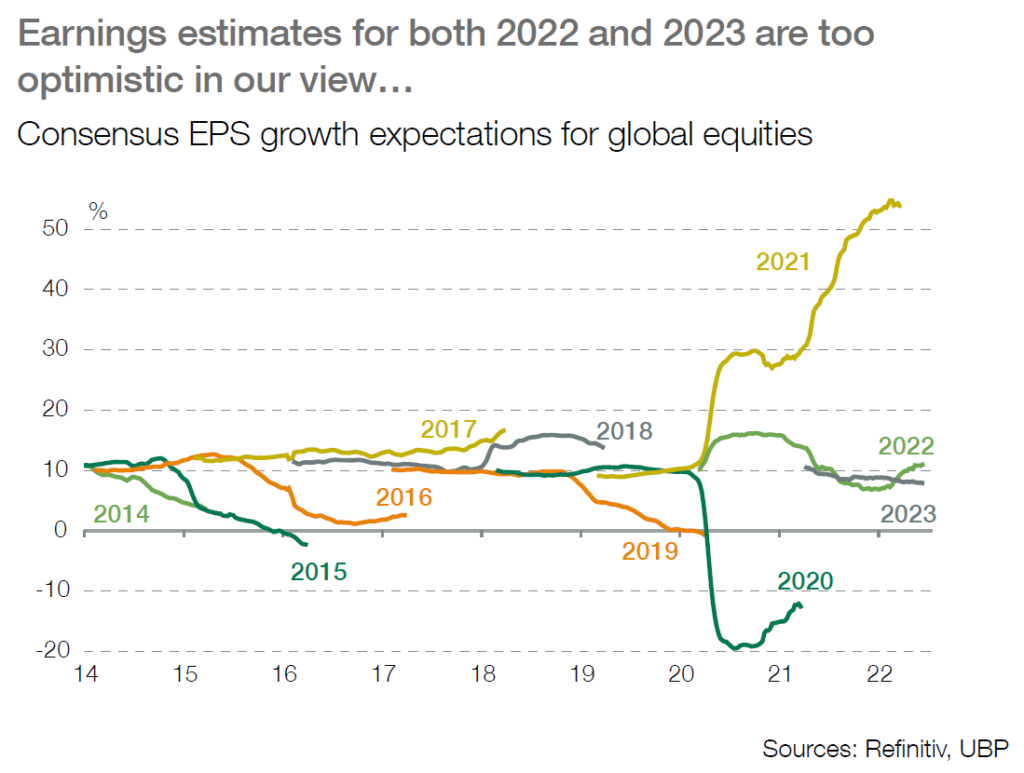

■ Ahead of the reporting season, earnings estimates stayed broadly flat over the last month; consensus 2022 EPS growth projections for global equities remained unchanged at 11%, with little difference between regions: 14% for Europe and 10% for the US.

■ Q2 EPS growth expectations for the S&P 500 index rose back to 6% thanks to energy (+18 pp to 215%), offset by a further decline for consumer discretionary (-3 pp to -4%). Estimates for other sectors were largely unchanged.

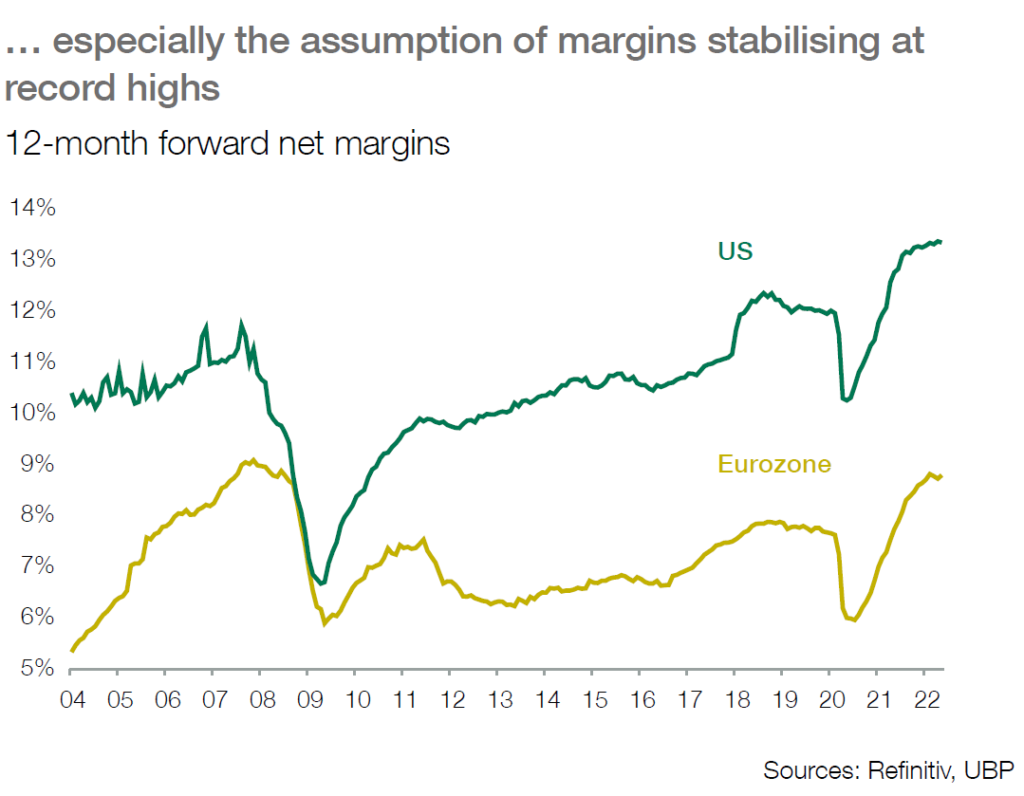

■ Ex energy, the expected EPS growth rate for Q2 falls to -2% y/y on a 7% increase in revenues. Some margin pressures in Q2 are therefore already included in arnings estimates, but not for the coming quarters, which looks unrealistic. Indeed, expectations for H2 are higher at 11% (about 7% ex energy).

■ Most companies should beat Q2 earnings estimates by a relatively wide margin, probably thanks to better-thanexpected revenues, but guidance is most likely to be rather cautious in the current environment.

■ The magnitude of downgrades will be highly dependent on how fast economic activity slows down in H2, especially consumer spending. With our economic scenario in favour of a significant downturn in H2, we expect arnings estimates to be revised down meaningfully to emerge finally with barely positive growth in 2022. In our base-case scenario, profits are likely to decline next year as companies will probably have lost their ability to raise rices.

■ We have added Chinese equities to our portfolio after their poor performance over the last year. Economic activity has likely bottomed while further stimulus is likely. Moreover, the credit impulse has turned, PMIs are rebounding and the regulatory uncertainty appears to be reducing. All these argue for a recovery in corporate profits.

■ The asymmetric strategies implemented in our portfolios reflect our caution on equities. Moreover, we continue to focus on companies which should be able to generate robust earnings and cash flows despite the major slowdown in activity that we expect.