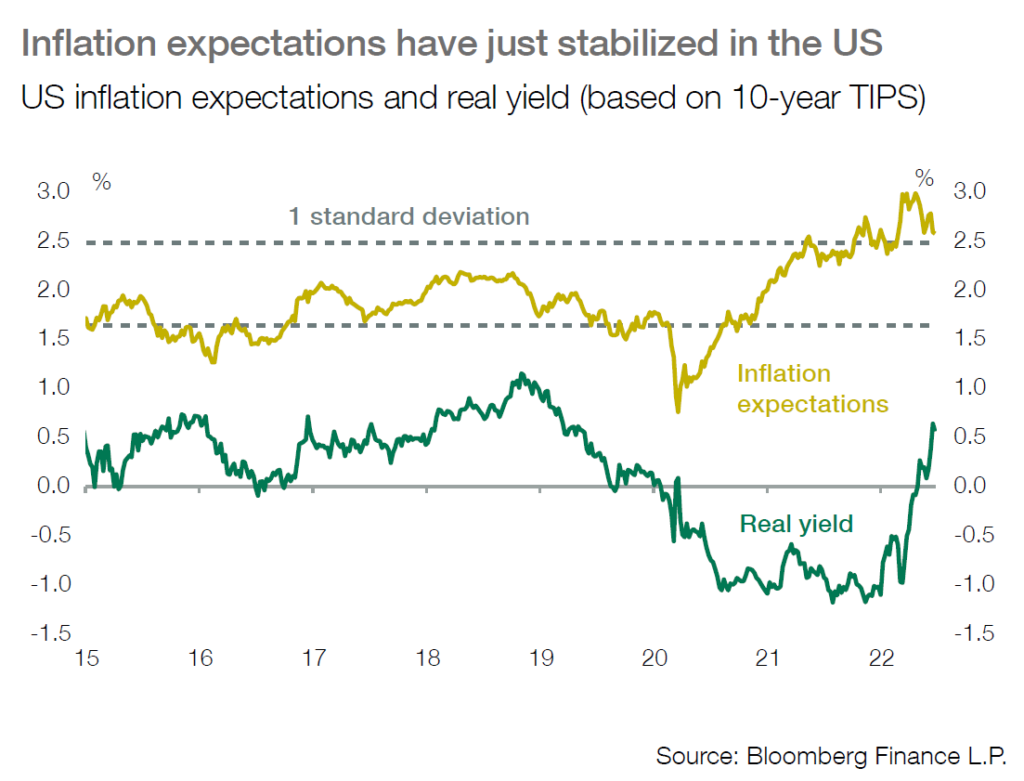

■ The repricing in government bond yields has continued over the past month, with concerns still in markets about volatile inflation and the confirmation of tougher monetary policy and substantial rate hikes over the coming months.

■ The US 10y Treasury yields have reached 3.47 % over past weeks and the 10y German Bund 1.76%. The US 2y TY was particularly volatile and rebounded over the month (3.42%), leading to some flattening of the US yield curve.

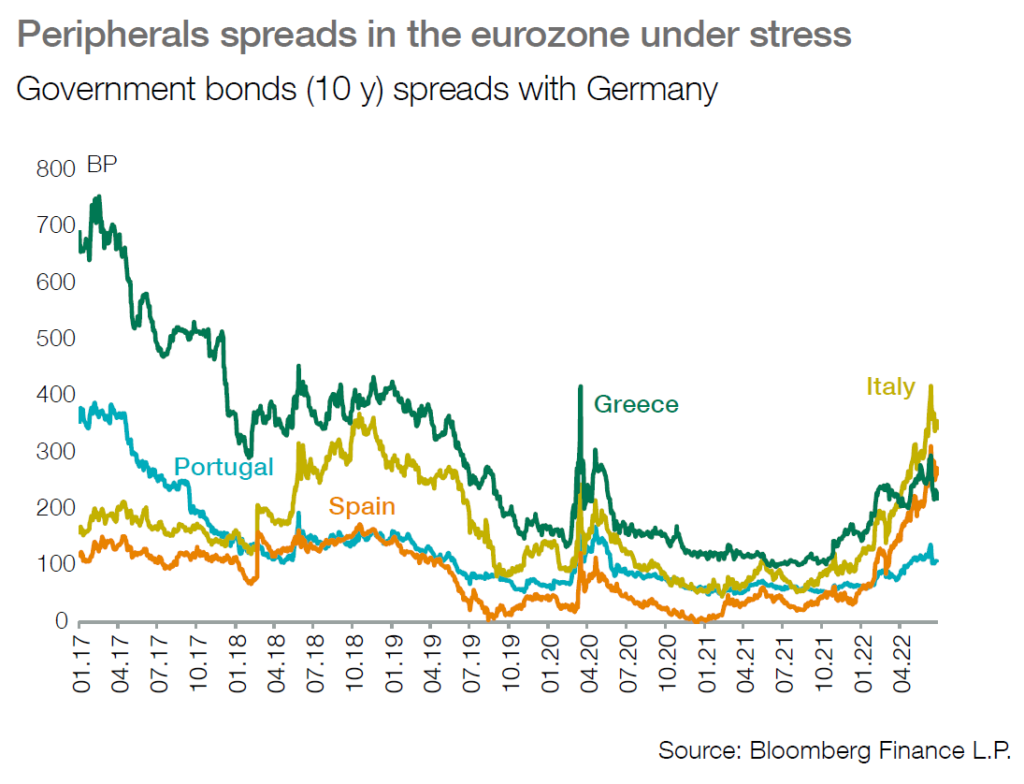

■ Pressures on bond yields increased in the eurozone with ongoing upside risks on inflation and after the ECB failed to present a credible anti-fragmentation plan for the area. Spreads of peripherals have significantly increased and obliged the ECB to have an urgent meeting and to promise a new detailed plan in July.

■ The ECB proposed to reuse PEPP coupons to reinvest into peripheral bonds under a flexible scheme. However, the new plan must show significant dedicated amounts, probably more than the reinvestment of the PEPP coupons, and a clear strategy on spreads to be credible. The lack of consensus among governors could lead to some disappointment in the plan and ongoing pressures over the next months on peripheral spreads.

■ Government bond yields have temporarily eased with renewed fears of recession in developed countries. Prospects of tougher monetary policy and a fall in activity have driven some flows into government bonds after the building of large short positions. Nevertheless, upside risks remain on yields due to the peak in inflation still being some distance away and the open window for larger adjustments in key rates by central banks over the next months. Our targets on US 10y Treasury yields remain unchanged at 3%-3.5% and 2% on 10y German Bunds and preference still goes to short duration positioning on average.

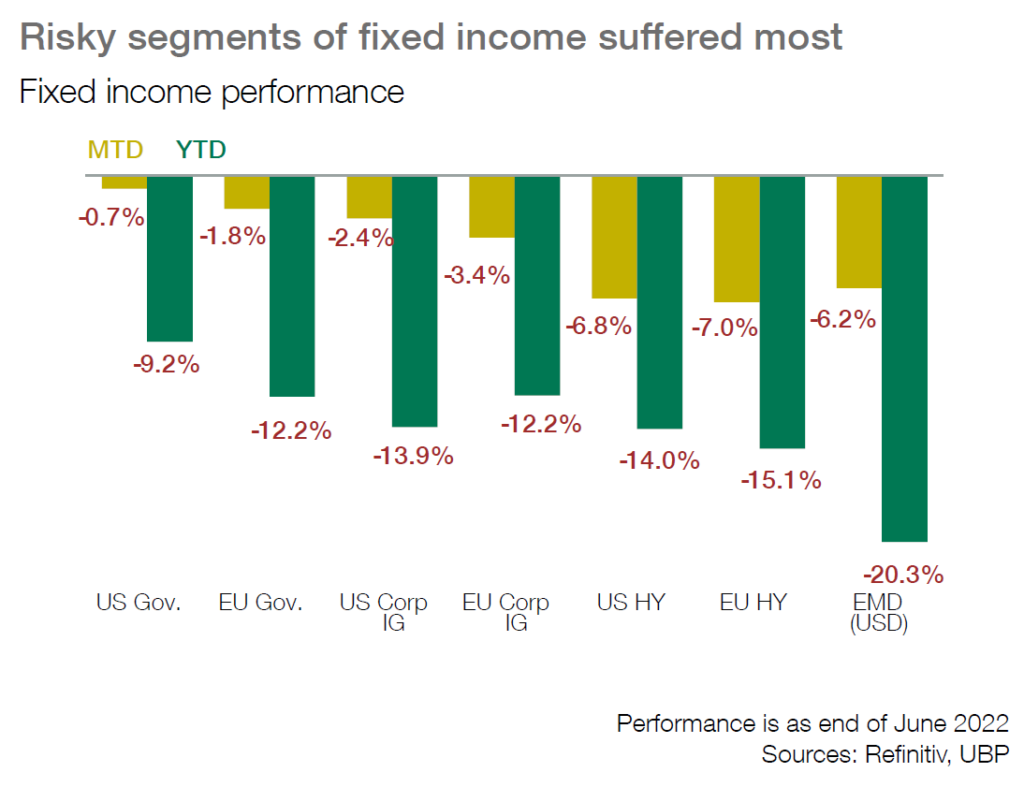

■ Credit spreads remained under pressure with prospects of a fall in activity. Fundamentals have deteriorated notably in Europe and corporate bond spreads have widened in parallel with the end of the ECB’s purchases. High volatility is expected in global credit spreads with concerns on growth and inflation, and a cautious strategy remains in place with a focus on credit quality. Preference still goes to hedge fund strategies within the fixed income allocation.