■ US domestic demand was up by an average of 2.3%-2.7% in H1-22, as consumption and labour were still resilient. Economic surprises have declined but were pointing to an orderly slowdown.

■ The political and monetary priorities of fighting against inflation have obliged the Fed to target growth below its potential during several quarters to bring inflation closer to 2% and to rebalance the labour market from being too tight according to the FOMC’s views.

■ In terms of growth momentum, this means that activity should slow down significantly in H2-22: domestic demand has to fall below a 2% trend for several quarters to alleviate inflationary pressures from the US cycle.

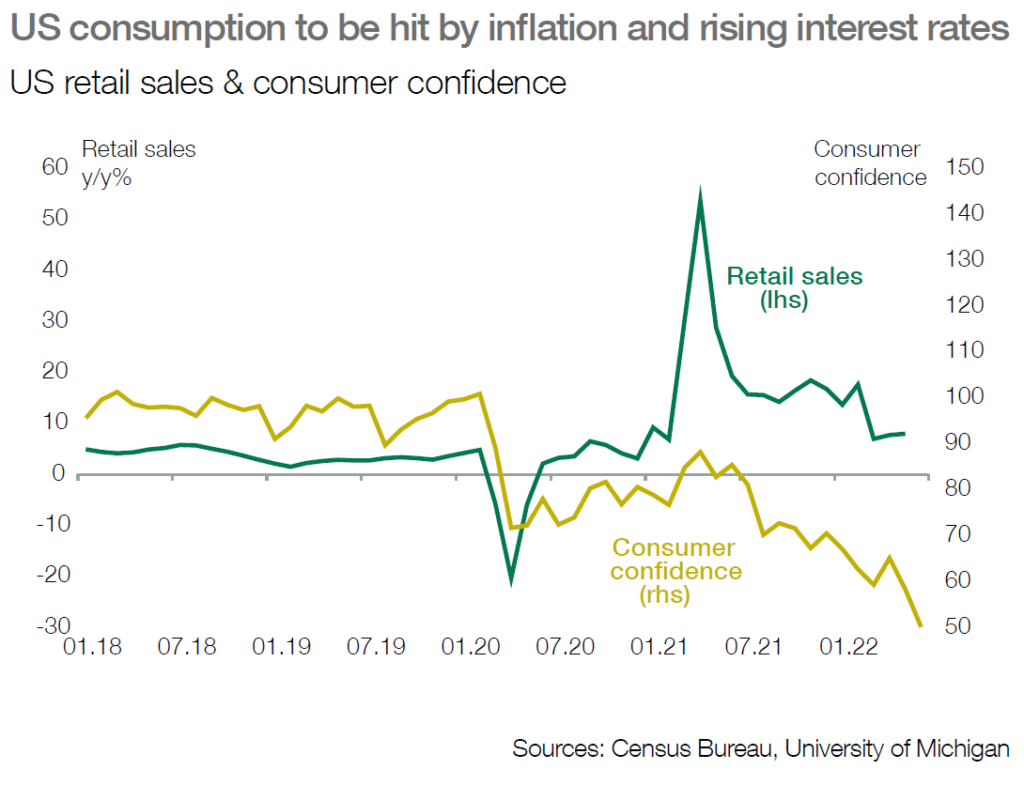

■ As a result, consumption and the housing sector should enter a more pronounced slowdown in the coming quarters as Fed policy will be tightened significantly; this will add monetary constraints to already existing downside pressures on net incomes due to record high inflation.

■ Facing slowing demand, firms will adapt their production, moderate their investment spending over the medium term and will finally reduce their demand for labour. The Fed’s scenario forecasts that the unemployment ratio will rebound to 4% by the end of next year, but upside risks exist.

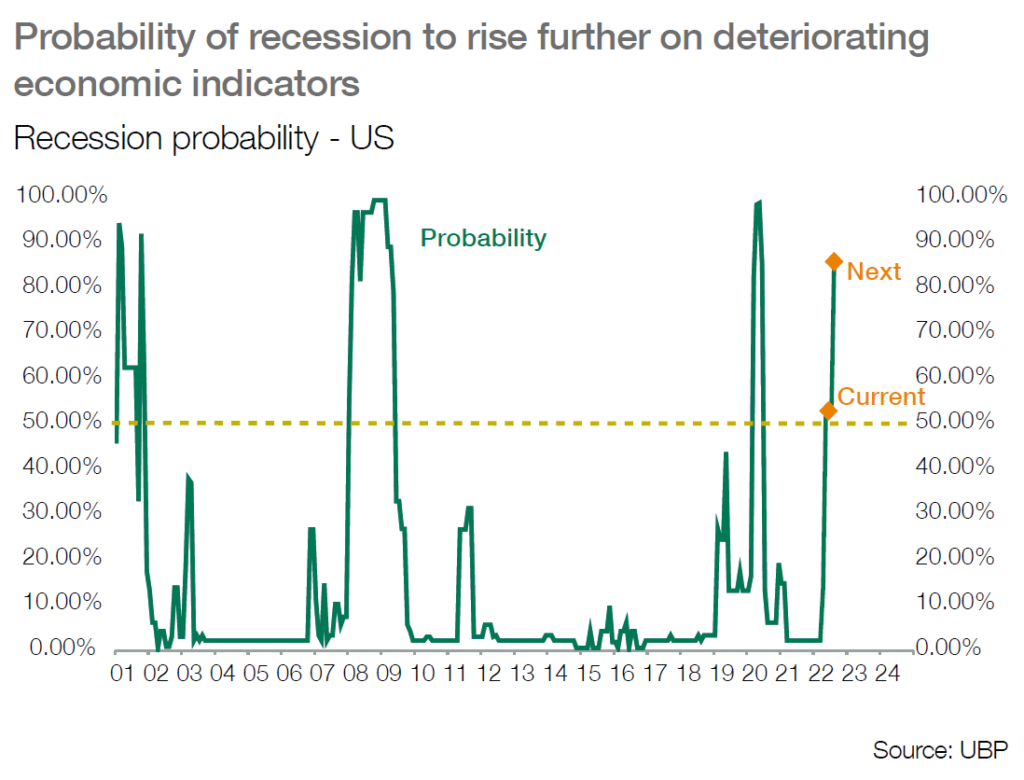

■ Fine-tuning an economic slowdown via strong rises in interest rates and a shrinking balance sheet looks particularly challenging for the Fed. M. Powell has recognised it in front of Congress during his latest testimony. In such a context, recession risks are rising rapidly and look as significant as they are in Europe, but due more to the Fed action than the war in Europe.

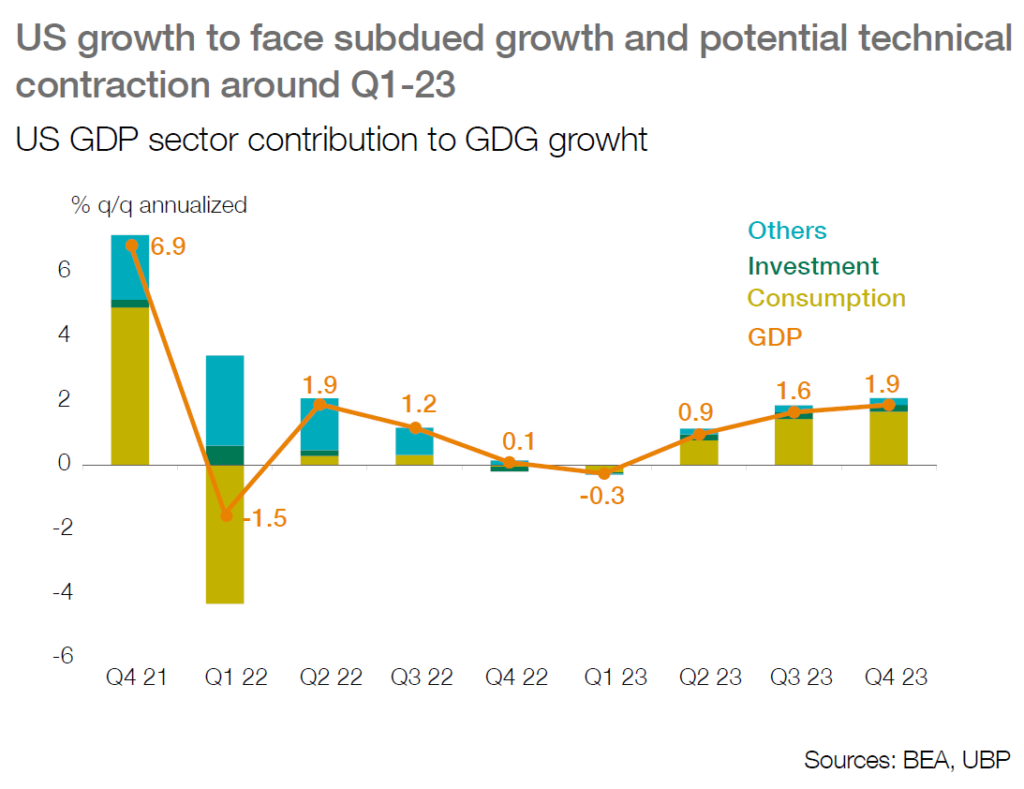

■ Growth should show a hard landing from the 5.7% realised in 2021 to 2% in 2022 and just 1% in 2023. Downside risks on GDP growth should finally materialise from Q3-22 and over the Q4-22/Q2-23 period, with a technical ecession to be seen around Q1-23 as domestic demand is likely to contract during this period.

■ No major new support is expected from budgetary policy, except some possible relief in gasoline tax ahead of the next mid-term elections; it is also too early to bet on any shift in the Fed’s rhetoric until inflation has elivered a clear peaking signal and key rates look to be above their neutral point.