Global economy / Asset allocation

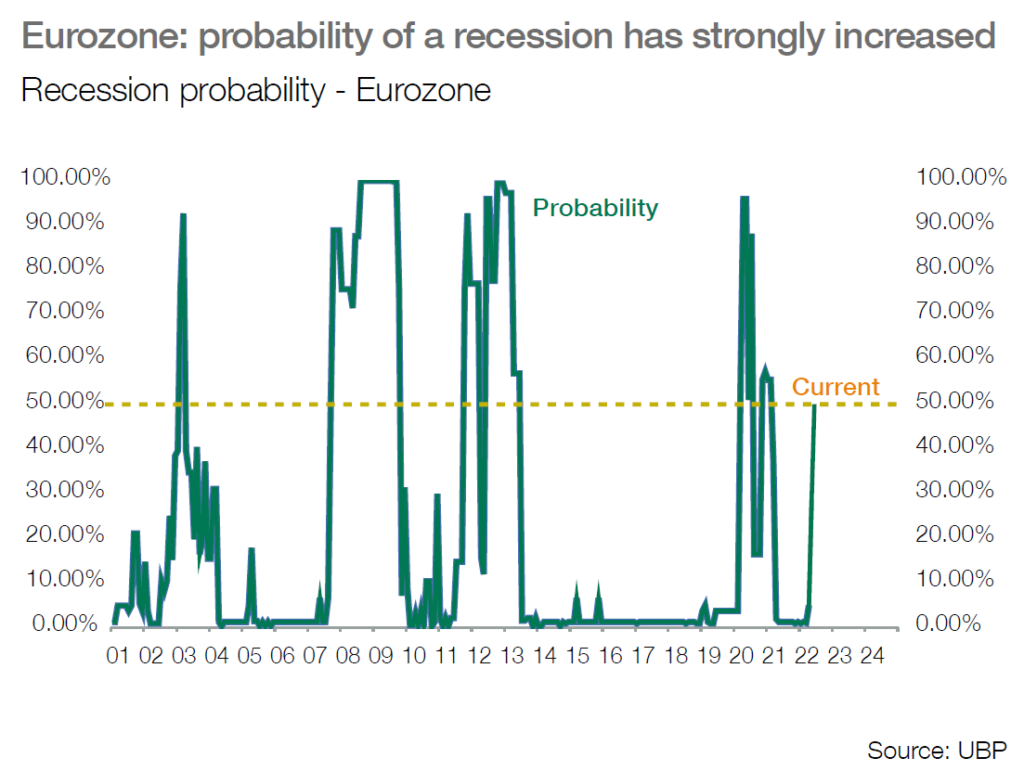

■ Recession risks have increased further due to high energy prices, war in Europe, ongoing geopolitical tensions and more restrictive monetary policy.

■ While tourism should drive demand in Q3, headwinds look set to push activity below its potential in Q4, on weakening domestic demand.

■ Inflation expected to remain high the next months, before declining later. Central banks will reinforce their tightening with aggressive rate hikes over the next three months.

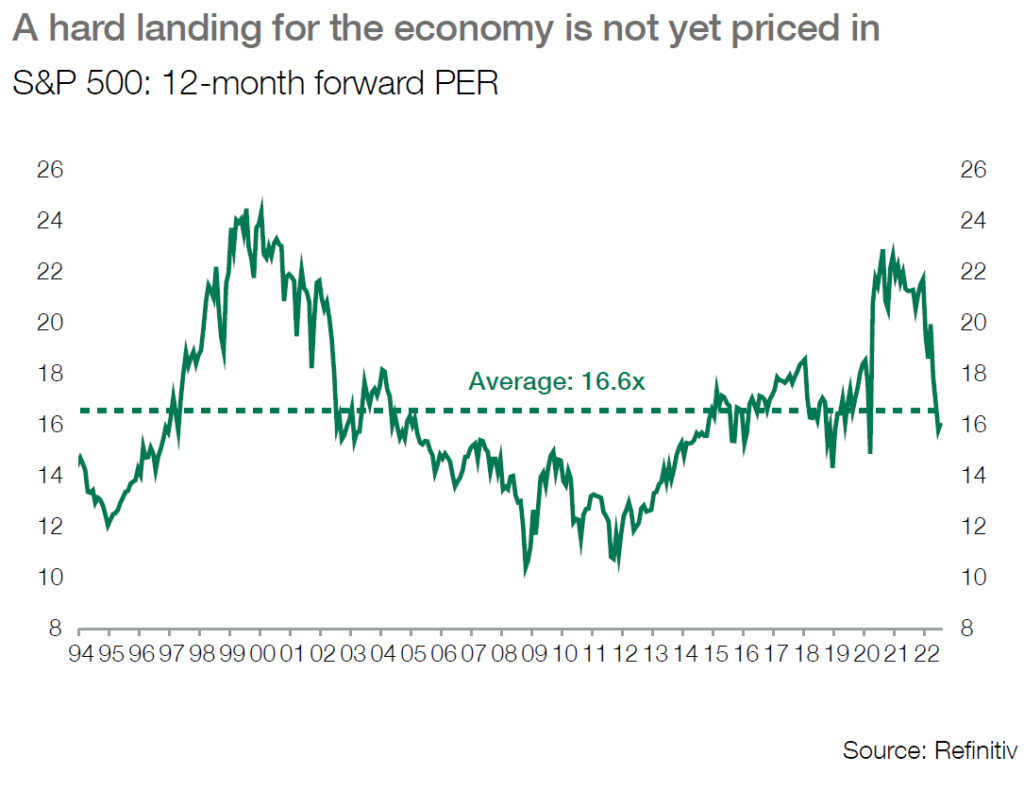

■ In this environment, active risk management is key. In addition to the protection already in place through put options since February, we replaced some directional equities with structured products providing upside participation while partially protecting downside risk.

■ With earnings at risk with current consensus of 11% growth in 2022, we continue to favour quality companies which provide better visibility and resilience going forward.

Fixed income

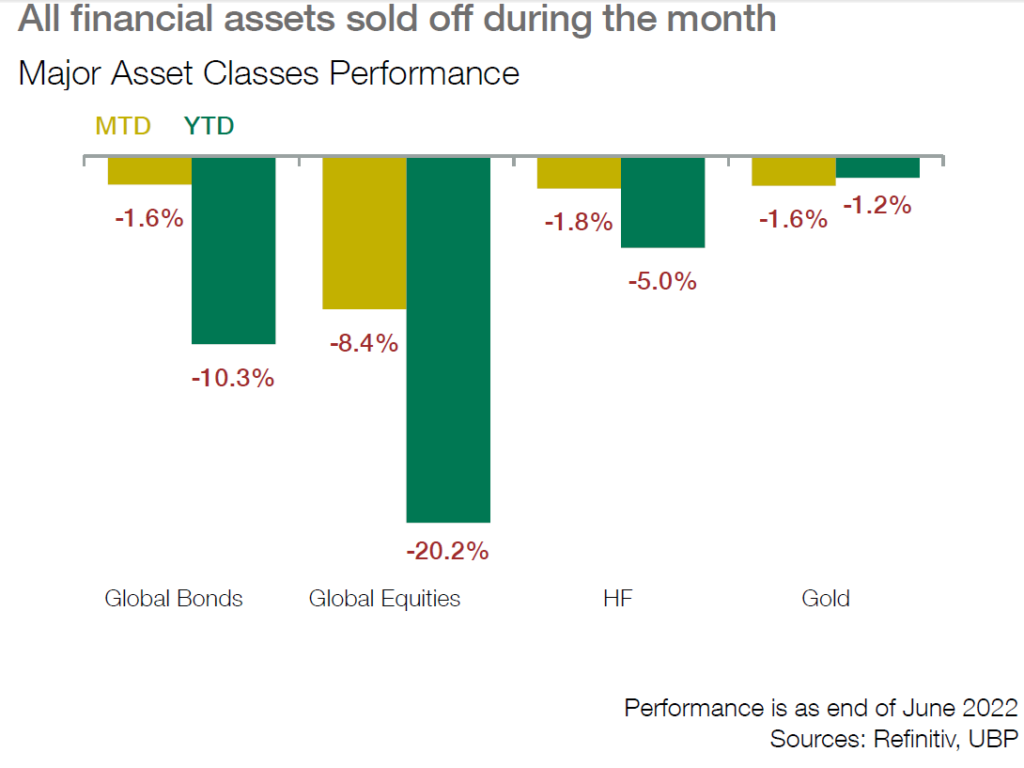

■ Government bond yields have reached high levels during the month before some temporary easing with building recession fears.

■ Upside risks remain on bond yields fuelled by still volatile inflation and central banks that will deliver substantial rate hikes over the next three months.

■ Short duration investment grade corporate bonds and hedge funds strategies remain preferred within the fixed income allocation.

Equities/ Alternatives

■ We remain cautious on equities and investors should reposition towards high visibility, high quality earnings and dividend streams looking through the summer to better weather the earnings uncertainty ahead.

■ With China’s macroeconomic backdrop improving supported by easing monetary and fiscal policy, we started to re-enter Chinese markets after having exited last year.

■ Hedge funds are particularly valuable in generating alpha in markets with high volatility. We rotated some directional exposure both in the fixed income space and in equities, providing some cushion to any further equity market sell-off as well as to rising rates and widening spreads.