■ Equities surged in November, with the major catalyst being the positive vaccine news in recent weeks.

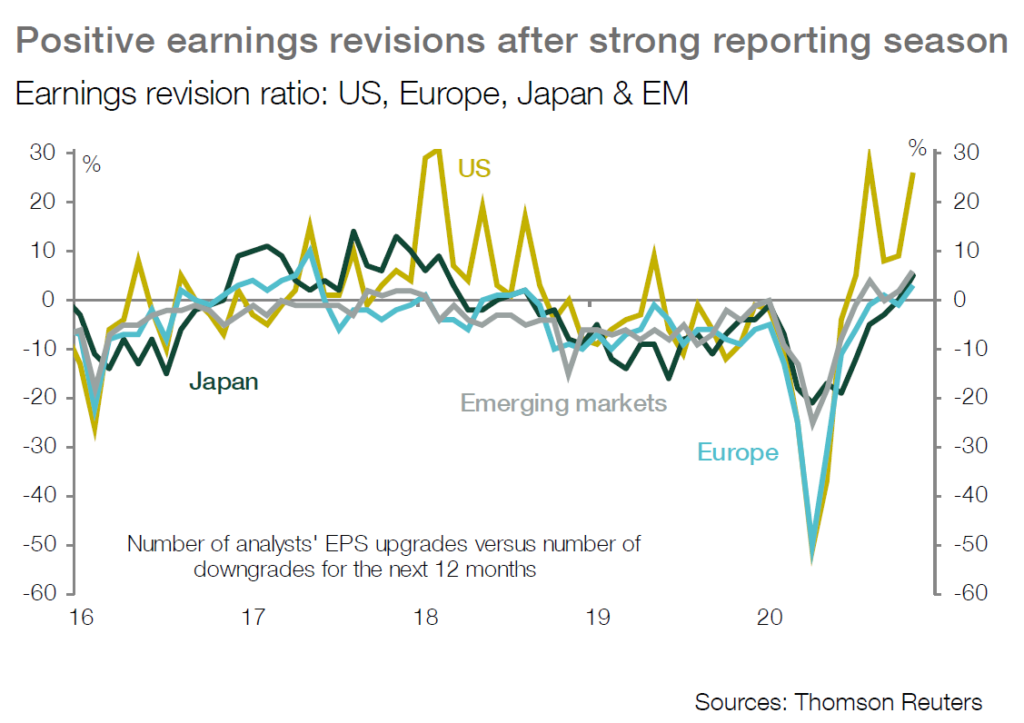

■ After the announcements of much better-than-expected Q3 earnings across the globe, revision ratios moved into positive territory in all regions, with the US again well above other markets, back to the same level as after the Q2 reporting season.

■ Over the last month, the expected EPS growth rate for global equities in the current year moved slightly higher to -17% from -19%, while the same rate for next year tilted lower to 28% because of the higher base.

■ With the rising probability of seeing an effective vaccine being distributed by mid-2021, the downside risk to global 2021 earnings has clearly receded. Upgrades are even likely for the sectors which have been most impacted by the virus like energy, financials as well as travel & leisure even though profits in these sectors will not get back to their 2019 levels before 2022 at the earliest.

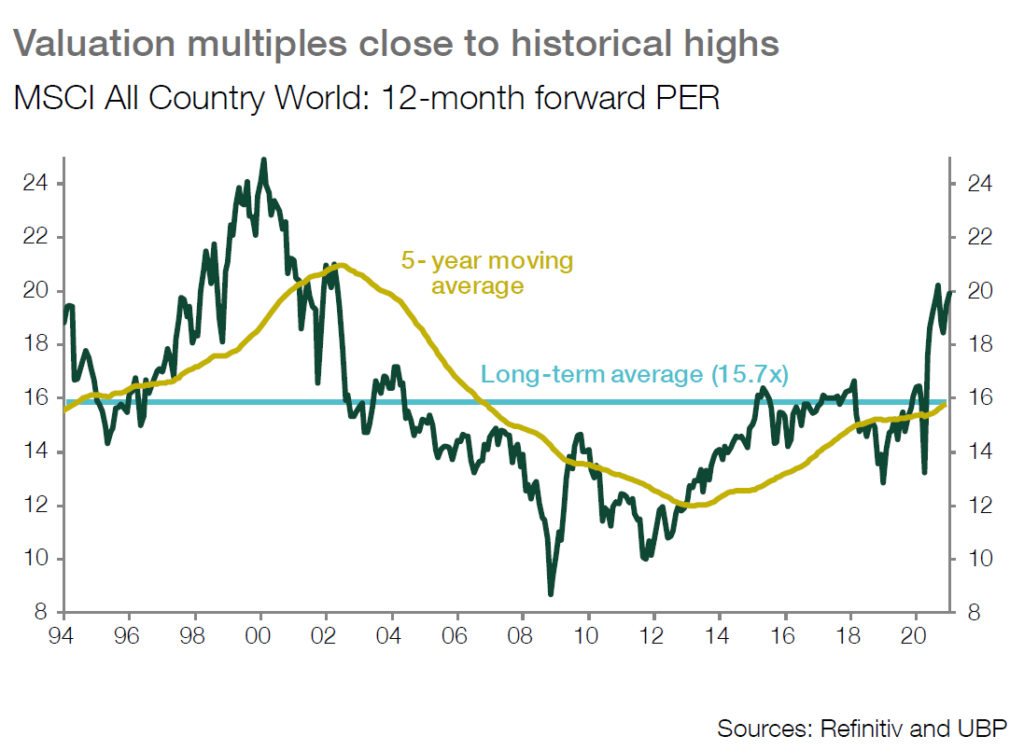

■ With the recent rally, equity valuations are back close to a near two-decade high. Consequently, earnings will be the key driver of equity markets next year. Valuation multiples are likely to move lower, but this should be more than offset by the expected earnings recovery.

■ In addition, above trend GDP growth next year will lead to a sharp rebound in sales so some value sectors will give opportunities for investors. However, because of those fundamental changes that will last even after the pandemic, some deep value stocks will not recover. Hence, selectivity will be key, and we will retain a quality bias to our procyclical equity exposure.

■ In portfolios, we prefer a barbell approach between quality cyclicals that should see earnings recovery in 2021 paired with long-cycle stories that offer earnings growth anchored in the transformation to a post-pandemic global economy including climate change/impact investing, China’s turn inward, fintech/digital finance and digital health.

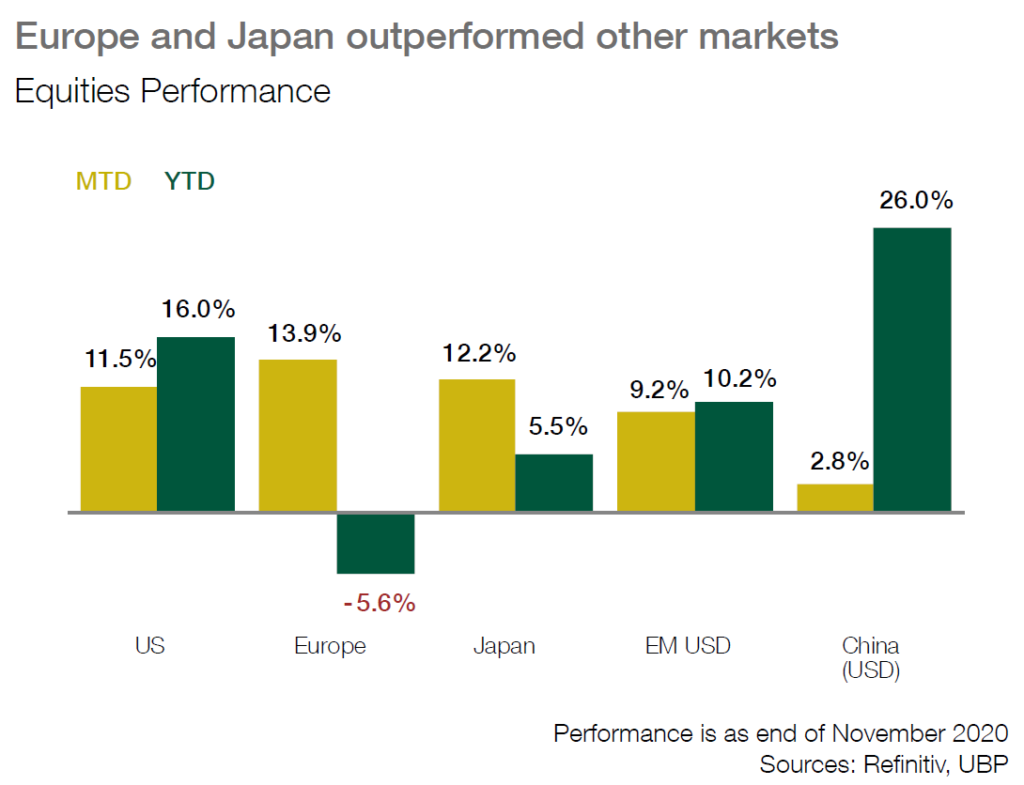

■ We have already built exposure to Europe which should disproportionately benefit from the global cyclical recovery via a sharp recovery in domestic economic activity as lockdowns ease, but also thanks to its sector composition. Japan and emerging markets are other regions with a cyclical bias which could offer opportunities going into next year.