Global economy / Asset allocation

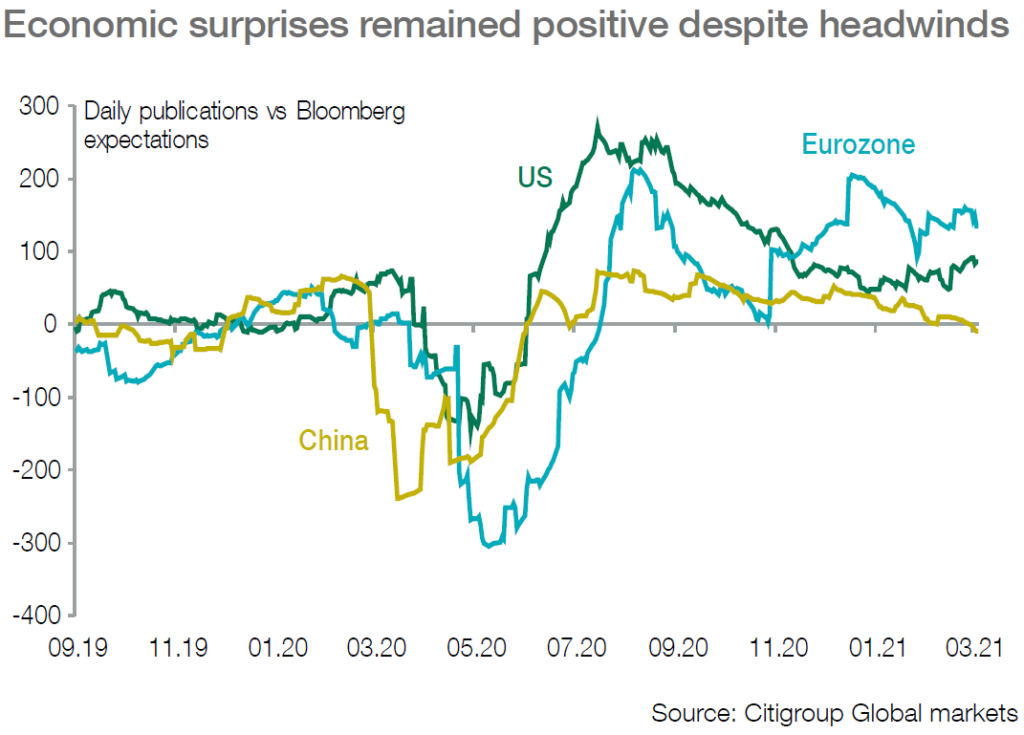

■ A still active pandemic combined with new variants and Euro area lockdowns keep short-term downside risks in view, particularly in the eurozone, but global activity seems resilient.

■ As vaccination rollouts accelerate, lockdowns should be eased in several countries in coming weeks and months, leading to a strong rebound in activity and sustained levels of global growth in H2-21.

■ Substantial budgetary support should come shortly in the US and the eurozone while monetary policy will remain accommodative in the short run.

■ We maintain our focus on medium-term recovery and secular transformation themes. We seek opportunities to add additional cyclical exposure which should benefit from the next leg of earnings recovery through 2021.

■ Proactive risk management remains valuable to allow us to stay invested in key long-term themes while being sheltered from near-term volatility and rawdowns.

Fixed income

■ With low/negative interest rates around the developed world, we believe Chinese government bonds and Asia credit are anchors to income-oriented portfolios as 2021 progresses. With the dollar weakening story of 2020 set to continue in 2021, investors can also enhance returns via FX markets in the year ahead.

■ Going forward, however, as the near-term outlook remains uncertain and with medium-term stimulus on the horizon, investors can benefit from a ‘barbell’ strategy between lower risk, moderate duration strategies and cyclical recoveryoriented exposure looking to the 2H of 2021.

Equities / Alternatives

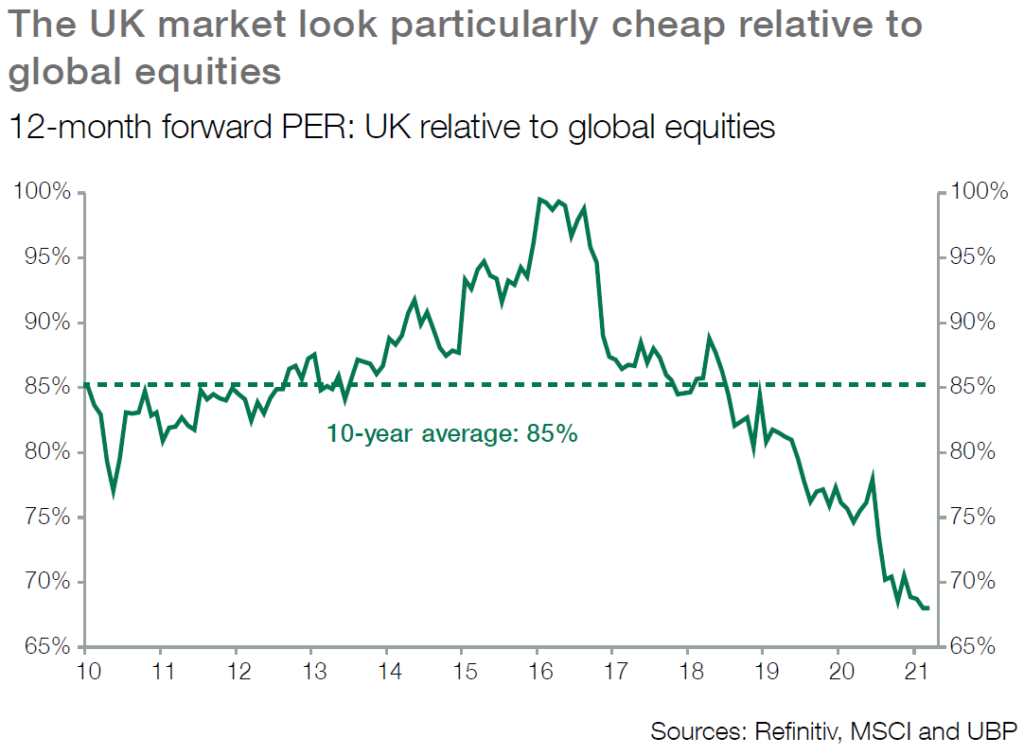

■ We have added UK equities to portfolios to add exposure to the global and domestic cyclical recovery story while maintaining our barbell approach between high-quality cyclicals and growth stories.

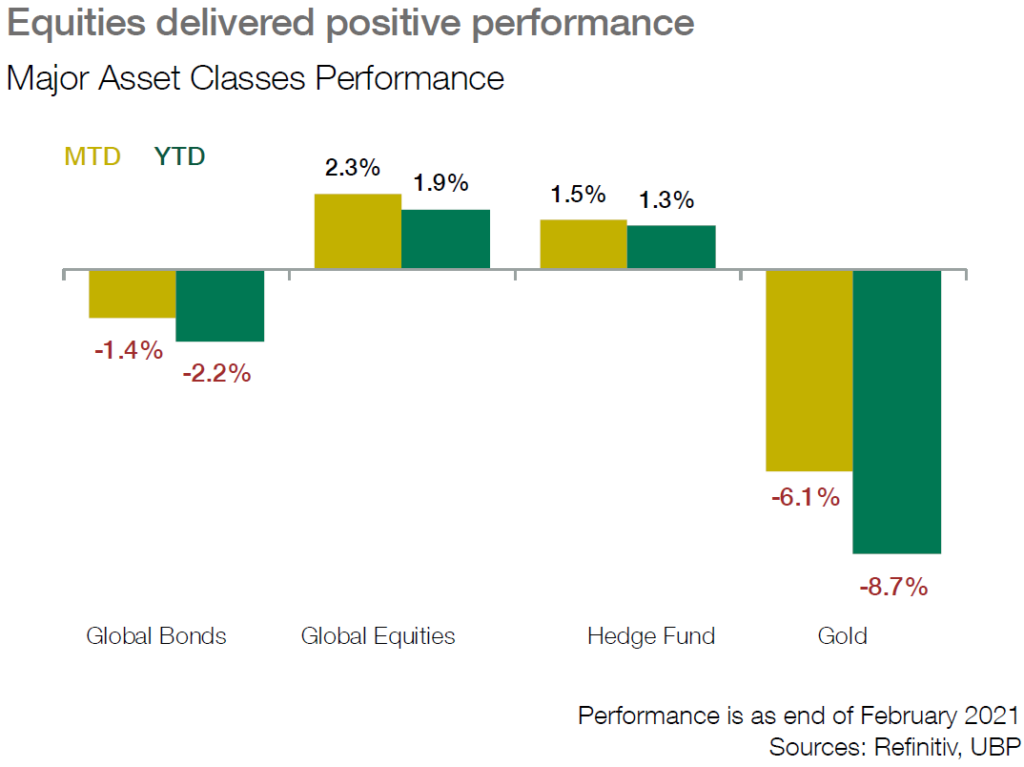

■ Long / short hedge fund exposure was particularly valuable in generating alpha in a highly volatile market environment, especially in emerging markets and China and acted as a complement to our strategic allocation built in 2020.