A change in regime: inflation is back

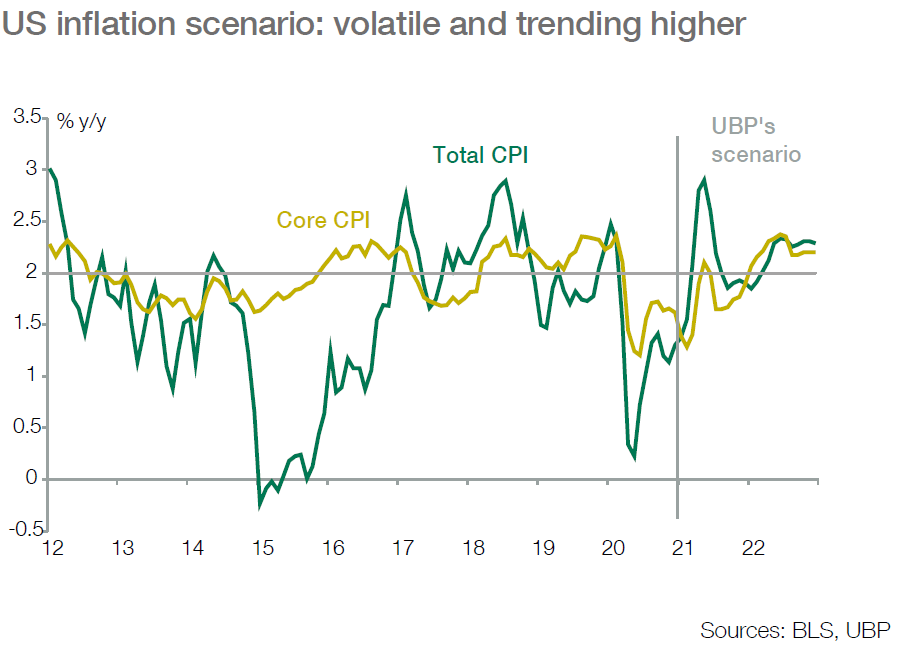

■ Inflation finished 2020 at a slow pace in all major countries due to weak trends in manufactured goods and services reflecting depressed demand under lockdown. It has now rebounded slightly driven by rising commodity prices.

■ As stronger growth is expected in the next quarters, inflation should progressively rebuild in 2021 and could trend higher into 2022 thanks to the accumulated stimuli.

■ After several years of staying below central banks’ targets, inflation in the next quarters should come closer to the 2% reference, mainly in the US. This is at a time when central banks become more tolerant on inflation and accept a temporary overshoot. The rebuilding process of inflation should result from three major steps over the coming quarters.

Rising costs push inflation up

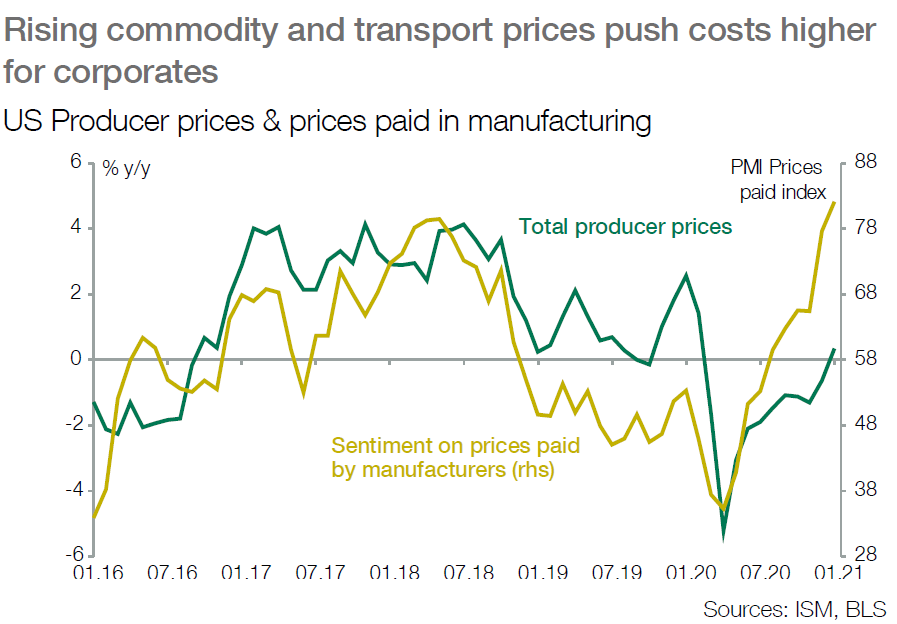

■ Commodities, security costs, freight costs and prices paid by intermediary manufacturers are up, fueling upside pressure on costs with some passing through to industry via the supply chain and sometimes on to consumers.

■ This process is working in Q1 and should lead to a stor ng rebound in headline inflation in Q2, mainly due to base effects on energy prices. However, inflation could stay at a high pace due to stronger demand and rising pressures on labour in the future.

Boost of demand on reopening economies

■ The reopening of economies should refuel pent-up demand for traded goods and services, as seen in Q3-20. Reopening hospitality and access to seasonal goods should lead to higher prices thanks to fiscal stimulus and accumulated savings.

■ Moreover, health costs could remain high due to needs for testing and updated vaccines. Finally, as governments are slowly but decisively moving forward regarding climate change, potential new environmental taxes in the coming quarters may add further to inflation pressure.

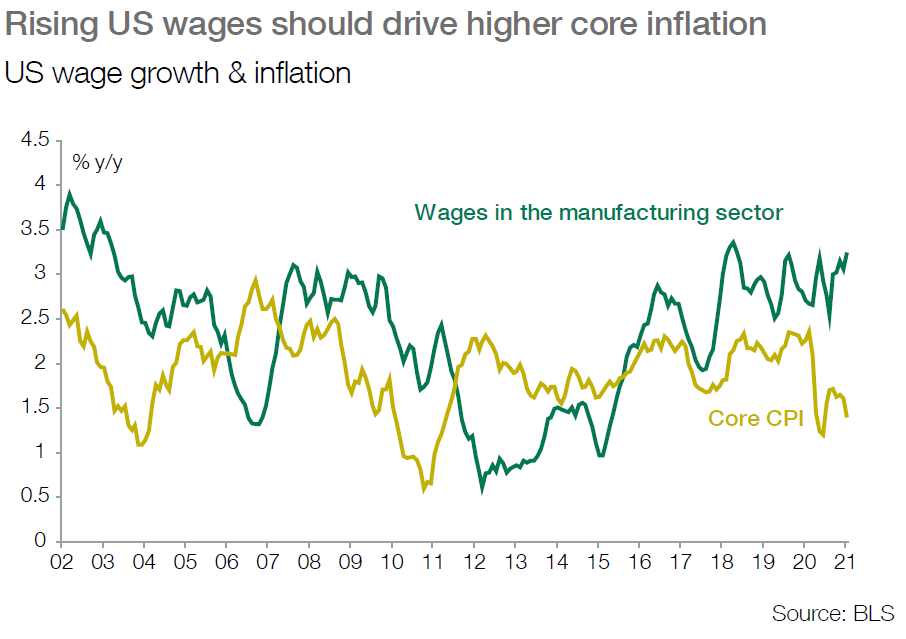

Full employment factor of wage-inflation rises

■ As central banks seem to target nominal growth and full unemployment in their exit strategy, more labour pressures could build as economies reopen. A higher employment demand in services and in industry could revive the pre-Covid moderate wage cycle at a time when labour force growth tends to slow down globally.